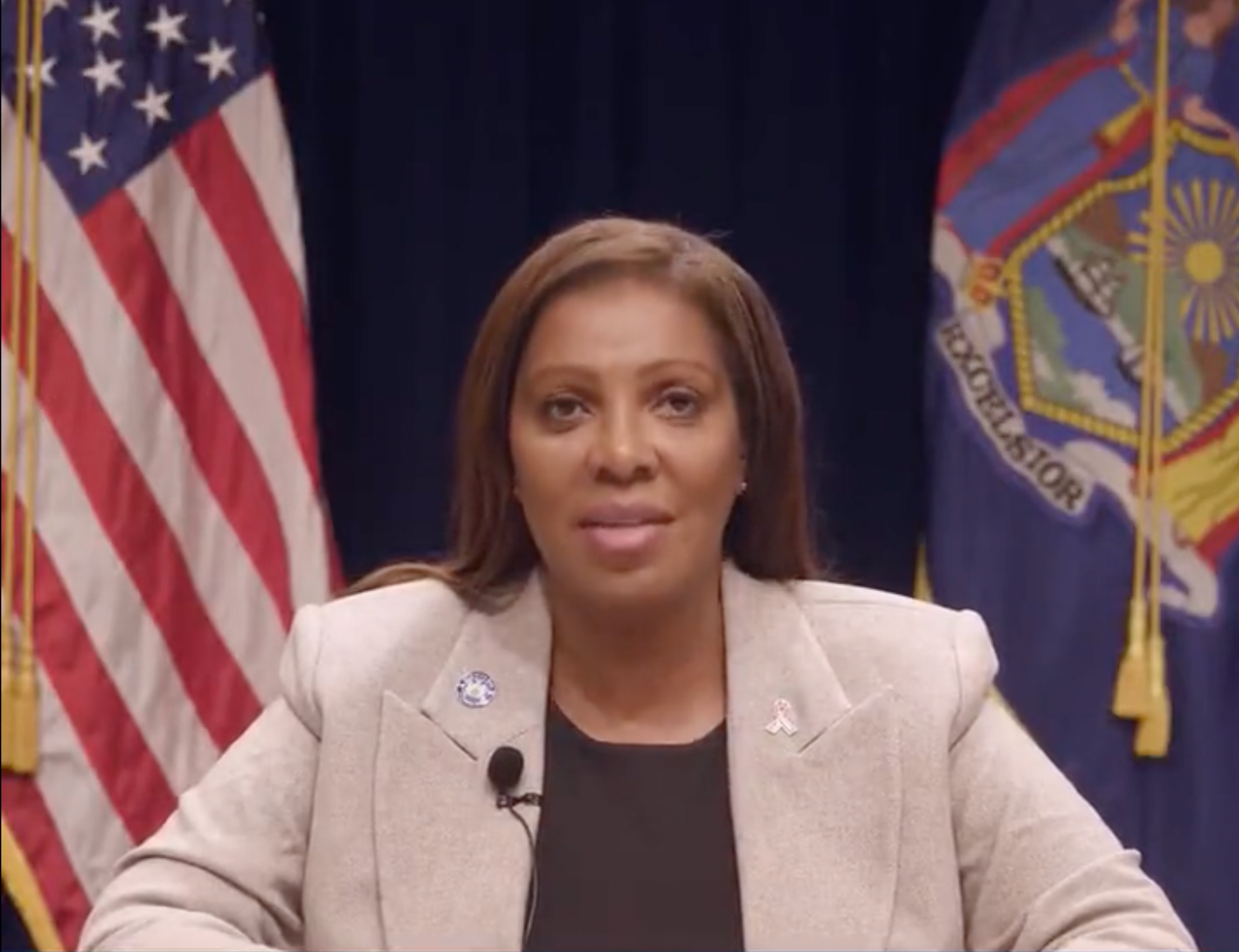

New York Attorney General Letitia James pulled a card out of Donald Trump's playbook by releasing a video of her talking to the masses about the sunny status of the fraud trial that her office is prosecuting.

"For years, Donald Trump evaded justice for his repeated and personal fraud," James said in a 1-minute video of her talking directly into a camera. "And as as we continue to present our case, we will show just how much he unfairly benefited as a result."

The trial is placing the 45th president and his sons, Don Jr. and Eric, along with their real estate empire under a legal magnifying glass.

After the first week witnessed salty theatrics of the former president, it continued into its second week with James accusing the Trump Organization for inflating its assets by billions starting from 2014 into 2020 before he left the White House.

When presented with a 1994 document that was signed by Trump assessing the Trump Tower triplex at totaling 10,996 square feet instead of 30,000 square feet, later claimed for years on financial statements, a once-close confidant to the former president didn't think much of it.

“I never even thought about the apartment. It was de minimis, in my mind,” Allen Weisselberg said. “It was not something that was that important to me when looking at a $6 billion, $5 billion net worth."

Weisselberg also admitted he didn't flag an appraisal of the Trump Organization's Seven Springs estate north of New York City that came in $230 million below what the financial statements suggested.

James showcased how they went after Weisselberg's for seemingly experiencing lockjaw on the witness stand.

"Yesterday we asked to confirm who had final signify on the fraudulent statements of financial condition at the center of our case. You know what he said? 'Good question.' And it was a good question. One of more than 100 that Mr. Weisselberg could not answer."

Also interviewed was Nicholas Haigh, a retired risk manager at Deutsche Bank.

Haigh confirmed that in order for Donald Trump to secure a $125 million loan from the bank for his Trump National Doral golf club, he had to keep a minimum net worth of $2.5 billion.

James maintains that the former president's honest net worth at the time of that loan agreement was only $1.5 billion.

Again, the AG turned his testimony into Trump condemnation.

"Today our witness Nicholas Haigh, a former risk manager at Deutsche Bank testified that he relied on those statements of financial condition to approve loans to the Trump Organization," she said on video.

"Hundreds of millions of dollars in loans with unfairly advantageous terms."

Leave a Comment

Related Post