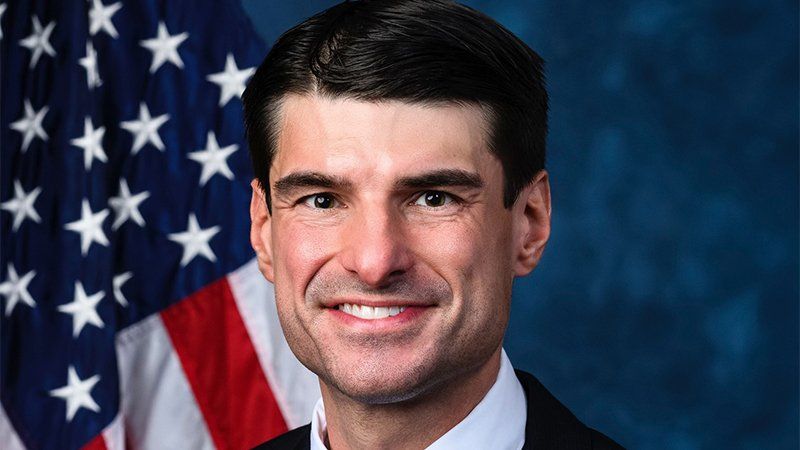

Northeastern Pennsylvania Republican Rep. Rob Bresnahan is drawing criticism from voters back home over his stock trades.

WHYY reported of Bresnahan's tele-town hall in which one woman who identified herself as "Ellen" asked why the lawmaker is ignoring his own standards.

"Hey, Congressman Bresnahan, ... I do want to ask you about stocks," the woman began.

"I'm actually not on Twitter, but every day, my husband shows me — he follows you," she continued. "And it's saying it follows a lot of people, but it's saying that you are performing really well. You're making all these trades. Yet I thought you were supposed to, like, stop trading. Is there any way you can kind of just explain what's going on there? Like, you know, I did vote for you. I'm really appreciative of you doing this for us and helping us with making better, but I didn't send you there to trade. So like, how can you help me understand this?"

WHYY reported that Bresnahan has been supportive of barring lawmakers from trading stocks, but he's not following those same standards.

Last week, the Wall Street Journal sorted through financial disclosure reports from lawmakers and found that Bresnahan "reported dozens of trades between April 2 and April 8, a week that saw the S&P 500 tumble and recover amid intense tariff-driven volatility."

Bresnahan told his voters that he had nothing to do with the stock trading.

“Like many Americans, I rely on a financial adviser to make these transactions,” he claimed. “I honestly have no idea what’s inside of the portfolio that I own. I see the PTR report that is filed at the end of the month, but I think you need to know that the trades are being executed on my behalf. I do not have any dialogues with my financial advisers.”

Those stock trades total 579 over the past calendar year, and about $6.56 million, the report said, citing the investment research firm Quiver Quantitative.

In 2012, Congress passed a law that intended to bar members of Congress from trading stocks based on inside information that they had access to as lawmakers. It mandates, among other things, that members of Congress must report their stock trades within 45 days, but they can use a "value" or "share price" rather than specifics.

WHYY noted that the bill has been criticized as weak. There's also very little enforcement of the measure.

The markets have been bouncing up and down since Trump announced his trade war, but some lawmakers close to Trump "appear to have made money during the market tumult," the report said.

The Journal reported that in April, during the tariff turmoil, the erratic trades by lawmakers "added to market uncertainty."

“The public should never have to question whether their elected officials are serving the public or their own portfolios,” Bresnahan told those on the telephone town hall. “That’s why I introduced the TRUST Act to restore the integrity Americans expect and deserve from their government. Members of Congress should not be allowed to profit off of the information they are entrusted with. This is a belief I’ve had since before taking office, and this belief has not changed.”

WHYY noted that the Republican only filed the TRUST Act "after he was criticized for such trades."

Read the full WHYY report here.

Leave a Comment