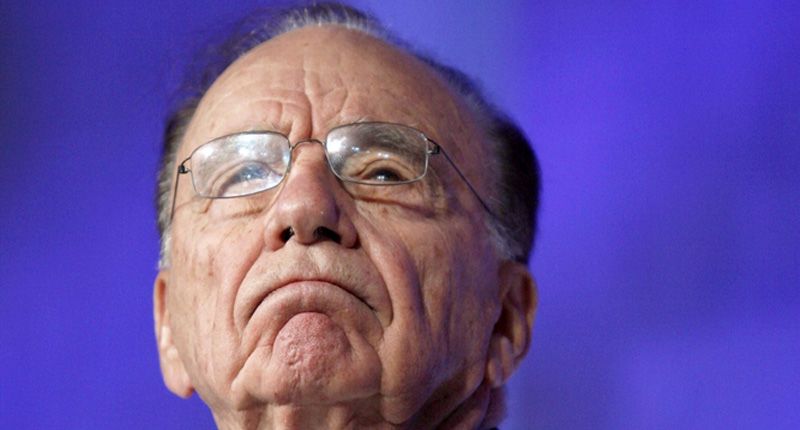

The latest court filings have been released in the lawsuit from Dominion Voting Systems against Fox News, and at one point in the documents, the lawyers give examples of News Corp. CEO Rupert Murdoch's influence over the network.

At one point in the documents, Dominion lawyers illustrate that power by highlighting Murdoch's power by describing his use of the network to lobby for the GOP's tax bill.

When Trump presented the joint-GOP tax bill, Murdoch told [Fox News CEO Suzanne] Scott that the network's purpose was to sell it to the viewers.

"He further agreed he 'would routinely suggest stories to Ms. Scott about what Fox News or Fox Business should cover,' and also in some instances suggested what guests should appear," the filing explains. "For instance, on October 14, 2020, Rupert suggested to Scott that Victor Davis Hanson would be worth putting on air' and two days later Hanson appeared on Fox News. ... When Trump resented a new tax bill, Rupert told Scott 'we must tell our viewers again and again what they will get.' ... And when Shepard Smith attacked the 'Trump administration's 'lies'' on air, Rupert emailed Scott and Jay Wallace calling it 'Over the top!' and telling them, 'Need to chat to him.'"

IN OTHER NEWS: Scott Perry's phone could contain 'blockbuster' evidence of criminal Jan. 6 actions

The Center for Public Integrity cited mega-donors handing huge donations to Republicans as a possible influence to the tax bill.

"From the time the tax bill was first introduced on Nov. 2, 2017, until the end of the year, a 60-day period, dozens of billionaires and millionaires dramatically boosted their political contributions unlike they had in past years, giving a total of $31.1 million in that two months," a Center for Public Integrity analysis of data revealed.

ProPublica reported in 2021 that IRS files revealed the ultra-wealthy were able to make major profits as a result of the GOP tax law.

"For the first time in American history, the 400 wealthiest people paid a lower tax rate than any other group," Forbes wrote in 2019 citing a new study by economists Emmanuel Saez and Gabriel Zucman at the University of California, Berkeley.

Leave a Comment

Related Post