The stock market is headed for a historically bad month thanks to President Donald Trump's economic policies, and panelists on MSNBC's "Morning Joe" were stunned.

The Dow Jones Industrial Average is on track for the worst April since 1932, while the S&P 500’s performance since Inauguration Day is the worst for any president going back to 1928, and the Wall Street Journal's editorial board wrote that Trump's tariffs are "the biggest economic policy mistake in decades."

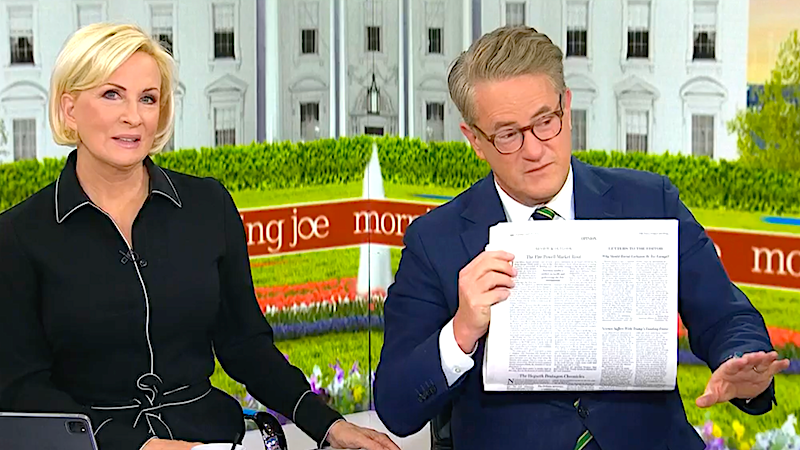

"'The markets are spooked because they don't know if Mr. Trump listens to anyone but his own impulses,'" said co-host Willie Geist, reading from the Journal's editorial. "It's a good time to bring in CNBC senior markets correspondent Dom Chu. Dom, good to see you this morning. Also from the Journal on the news side, this headline this morning, Dow headed for worst April since the Great Depression. What is this all about?"

"Oh my God," interjected co-host Mika Brzezinski.

ALSO READ: 'We know where this leads': How Trump’s crackdown puts Jewish people in peril

"So basically what we have is a situation where over the course of the last several weeks, there's been a evolving narrative, if you will, right," Chu said. "We talked about this notion that with new policies, especially on the tariff front, what you have is a new degree of uncertainty brought to global markets, global trade that then manifests itself in the way that markets have reacted with some of that downside volatility."

The American economy has long been the stabilizing for the global economy, but Trump's moves have cast doubt on the dollar's trustworthiness, Chu said.

"In the course of the last few weeks, there has been a little bit of chatter early on about the luster coming off some of those assets, the U.S. dollar and the U.S. treasury side of things over the course of the last couple of weeks," Chu said. "There is now a full-blown debate in certain parts of Wall Street about whether or not there is a market shine coming off the value of the U.S. dollar and the U.S. treasury market. In no way is anybody out there saying that the U.S. dollar is still not a reserve currency. There is in no way anybody saying that the U.S. treasury market is not the place that you want to be. But when you have a possible paradigm shift, a change in thinking about the way that the dollar is valued and viewed in the global market, the way that our sovereign bonds, the U.S. treasury market, is viewed in the market, that that shift or potential shift is enough to have traders and investors, not just here in America, but around the world, questioning whether or not you have to change the way that you think about it."

Host Joe Scarborough thanked Chu for his analysis and agreed that uncertainty was the fault of one person, and one person only.

"All of this depends on what Donald Trump decides he wants to do," Scarborough said. "I think that's what's rattling the markets, is that it's one person who's deciding how far he takes, takes this. But the United States does remain this this massive economic power, and this while this has been the worst April since the Great Depression. One wonders if he starts striking deals with the UK, with Europe, with Japan, with South Korea, and stops talking about Jerome Powell. One wonders if that market doesn't go back up."

Watch the video below or at this link.

Leave a Comment