Federal Reserve chairman Jerome Powell avoided a showdown with Donald Trump during his first term, but he may not escape the once and future president's wrath next time.

Powell clearly hopes to avoid getting caught up in political drama with the economy headed toward a "soft landing," but a confrontation with Trump looks inevitable because many of his top allies, including Elon Musk and Project 2025 architect Russ Vought, have urged him to seize control of the Fed or undercut its credibility, wrote Washington Post columnist Catherine Rampell.

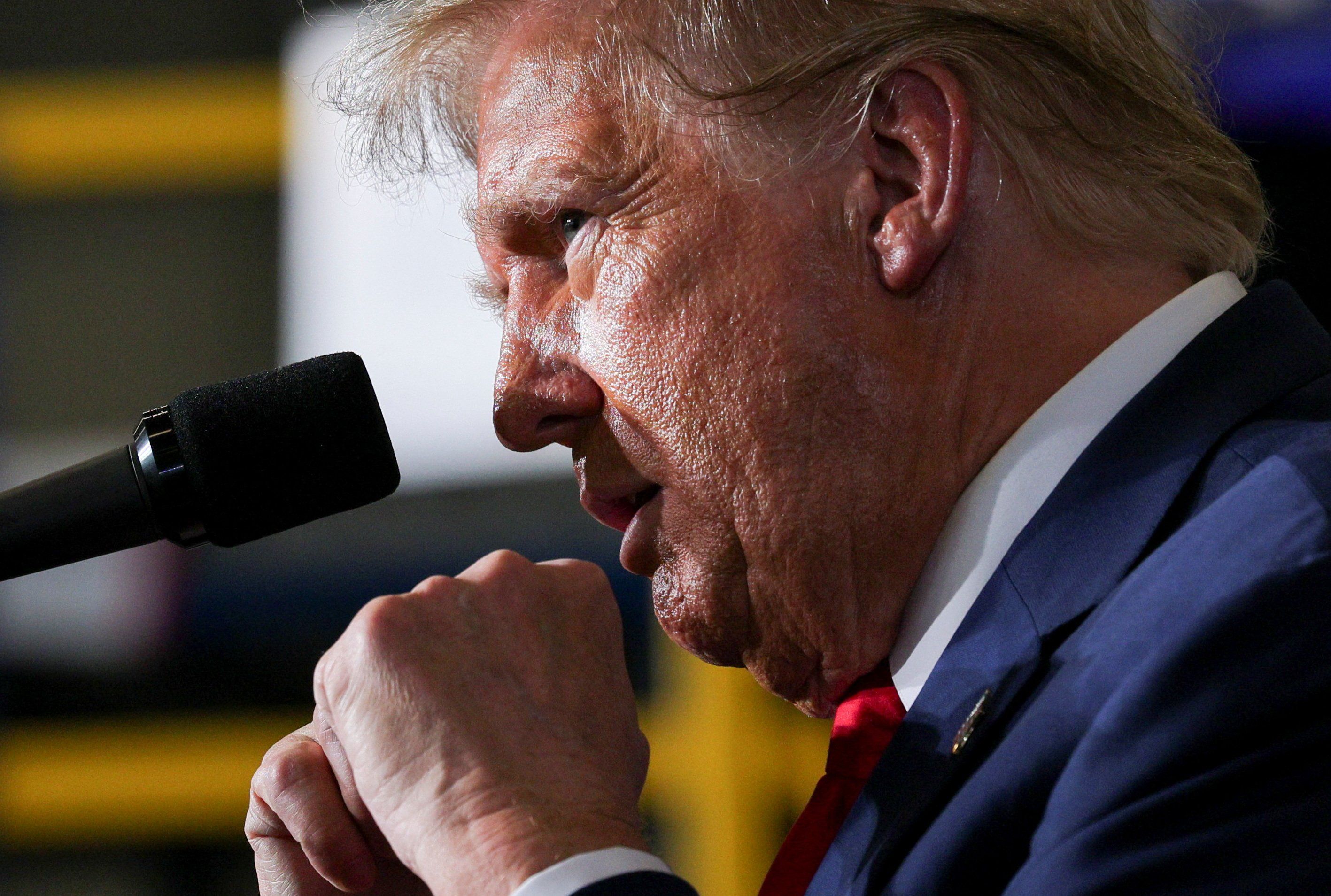

"During his first term, Trump threw tantrums when the Fed modestly raised interest rates, even as the economy was booming," Rampell wrote. "He called Powell an 'enemy' and threatened to fire him. (This likely would have been illegal.) Trump also tried to appoint political toadies to Fed positions to undermine Powell and other central bankers."

ALSO READ: A giant middle finger from a tiny craven man

"Trump’s vandalism didn’t succeed, partly because Powell showed backbone and partly because Trump’s own aides and allies foiled him," she added.

However, the former president made clear that he wanted to pressure the Fed to slash interest rates and print more money, which makes voters feel richer and more satisfied with the economy, but that runs the long-term risk of fueling inflation.

"That’s why it’s a bad idea to put politicians in charge of the money supply (see Venezuela, Argentina, Turkey)," Rampell wrote. "Countries whose central banks are more insulated from short-term political pressures tend to have more price stability. When central bankers can focus on long-term economic health rather than an imminent election, they’re more willing to 'take away the punchbowl.'"

The Fed's interest rate hikes in recent years appear to have succeeded in bringing inflation close to its 2 percent target, and the economy is looking strong, but even modest cuts to interest rates may not keep Trump from picking a fight with Powell.

"That’s because so much of Trump’s economic agenda is likely to be inflationary (deficit-financed corporate tax cuts, global tariff hikes, mass deportations), which would traditionally lead to more 'restrictive' Fed policies (e.g., higher rates)," Rampell wrote. "Powell and his colleagues clearly wish to stay out of the political fray. But the fray might be coming for them."