A Donald Trump-backed Republican candidate for a key Texas U.S. House seat who touts his record locking up child predators served as lead defense counsel for officials including a high school football coach accused of forcing a minor to perform exercises nude, court records show.

Eric Flores was, for about two months, lead counsel for employees of the Edinburg Consolidated Independent School District (ECISD), in the Rio Grande Valley region, accused in a civil lawsuit filed in Hidalgo County, Texas, in September of inflicting "trauma, abuse and injustice upon a vulnerable student.”

Now, Flores is one of eight Republicans running in the March 3 primary for Texas’ 34th Congressional District.

Flores announced his run for Congress last July. An Army veteran and partner at O’Hanlon, Demerath & Castillo, he raised more than $872,000 through December, the third-most of the GOP candidates, according to Federal Election Commission records.

Trump endorsed Flores in December, touting an “America First Patriot” who “knows the wisdom and courage it takes to ensure law and order.”

Republicans are targeting the 34th District, carried by Trump in 2024 but held by Rep. Vicente Gonzalez (D-TX), who won the seat by the slimmest margin in the state, according to the Texas Tribune. Gonzalez faces one challenger in the Democratic primary.

Amid mid-cycle redistricting battles, redrawn Texas maps, permitted by the U.S. Supreme Court, have made the state more favorable to Republicans. The 34th District is primarily Latino but now incorporates part of a whiter Republican-led district, the Tribune reports.

Of the Edinburg district case, Flores told MySanAntonio.com in November: “The District disputes the allegations and stands by the integrity, professionalism, and dedication of its employees.

“Our focus remains on serving our students and families with the highest standards of safety, respect, and excellence in education.”

Flores’s campaign acknowledged Raw Story’s questions but did not provide comment.

‘Emotional distress’

Flores withdrew in November as lead counsel for Robert Vela High School Coach Ernie Alonzo and co-defendants Principal Michele Peña and ECISD Athletic Director Oscar Salinas, according to court filings. The court proceedings are ongoing.

The lawsuit alleges Alonzo ordered a minor student to “perform strenuous physical exercise completely nude” and “threatened and ordered him to remain nude” when he attempted to cover himself with underwear.

The lawsuit accuses Michele Peña and Salinas of knowing of complaints about Alonzo’s alleged “proclivities” and ”illegally cover[ing] up crimes of the politically protected, even if those politically protected are potential pedophile political hires.”

Raul Rocha, the parent of the student named only as N.R., is seeking damages for medical expenses and “emotional distress,” his lawyer, Javier Peña, told Raw Story.

Rocha is seeking between $250,000 and $1 million in damages, according to the lawsuit.

Kevin O’Hanlon, founding partner of O’Hanlon, Demerath & Castillo, representing both the district and individual defendants, said he took over from Flores as lead counsel because “I've got more experience than him, and he was busy.”

Flores filed the original answer to the suit because “he was available, and I was in a trial,” O’Hanlon said.

Flores’ campaign for Congress “indirectly, I suppose” contributed to the decision to remove him from the case, O’Hanlon told Raw Story.

“We were looking at his caseload in light of his time commitments, not because of the matter involved,” O’Hanlon said.

“It wasn’t about the case. It was just about balancing the case loads amongst the lawyers in the firm.”

Javier Peña told Raw Story Flores’ congressional run has not affected the case, but said: “I was surprised he would get involved in this kind of case. He quickly got out of it, I think, once he saw the facts of the case.”

Peña said he knows Flores through legal battles, both against each other and on the same side.

“I don't know what the reason why Eric got out of it, but whatever the reason was, it was a good choice on his part, or the firm's part,” Peña said.

ECISD spokesperson Lisa Ayala said: “We can't comment on pending litigation, and attorney staffing decisions are made by the firm, not the district.”

‘Temu version of Epstein’s Island’

Before Flores withdrew from the case, he signed a plea to the jurisdiction arguing claims against the defendants were barred by governmental immunity “because all the alleged actions involved professional school employees exercising judgment, were discretionary acts, no defendant used excessive force and there was no negligence resulting in bodily injury.”

O’Hanlon told Raw Story the defendants were “immune — that’s what the statute says.”

“There isn’t any alleged sexual misconduct,” O’Hanlon said.

The plaintiff is “saying it, but there's no indication of it. Had the guys do some coach discipline is what it was. Wasn’t any sexual misconduct here,” O’Hanlon said.

O’Hanlon said the coach did not tell the student to “practice naked” but “told him to do some calisthenics, and he walked off.

“Discipline is in the scope of the employee’s duties of students, especially student athletes … they make all these allegations that will get everybody worked up in the media, but there's immunity here.”

Javier Peña said: “They're trying to defend the sexual assault as discipline, but their own clients have already admitted that's not what it was. This was an assault. There was attempted cover-up.”

Texas law outlines permitted forms of discipline by school employees, including corporal punishment, if a board of trustees for an independent school district adopts a policy allowing it.

Peña said: “Having kids exercise in the nude — shouldn't be surprising to most people — is not within the list of what's allowed by school teachers or coaches.”

Peña said he submitted a motion to disqualify O’Hanlon, Demerath & Castillo because the firm represents ECISD as well as another district where Alonzo “allegedly engaged in similar activities.”

An amended petition said O’Hanlon’s partner, Benjamin Castillo, as the school’s attorney, met with the minor and his parents and “admitted that the assault occurred.”

“They've already admitted to basically every central element of our cause of action and to the damages,” Javier Peña said.

“They've admitted they made these kids, at least four, if not more, exercise in the nude, straight out of the shower. Coach was watching them, admitted it was outside the course and scope of their employment, admitted the child was harmed, admitted that Coach has never been punished, things like that. It’s insane that these lawyers have allowed that to happen.”

Calling the situation “dirty politics all around,” Peña said: “This is like [the] Temu version of Epstein's Island. They're just covering up and protecting people and all engaged in these shenanigans.”

‘Damage the credibility’

Though Flores only appeared on court filings from September to November, his work on the case “will be a selling point for his opponent,” said Jamie Wright, a Los Angeles-based trial lawyer who has represented school districts.

“It will be a good talking point for the opponent, and then he's just going to have to clean it up and answer it directly,” Wright said.

Wright compared Flores’ situation to that of Rep. Derek Tran (D-CA), a Democrat elected in California's 45th Congressional District in 2024 amid concerns raised about legal clients including a man fired for displaying a noose in his office, Politico reported.

Flores prosecuted cartel-related and human trafficking operations as an assistant U.S. attorney, according to his campaign website.

His campaign Facebook page posted in August that he attended the opening of a forensic exam center for victims of sexual abuse and assault.

“As a prosecutor, I’ve seen how vital this work is, I’ve helped put child predators behind bars, and resources like this make all the difference,” the post said.

“Proud to see our community come together to protect the most vulnerable!”

Adin Lenchner, founder of Carroll Street Campaigns, which works with Democrats, said voters have a right to scrutinize a candidate’s history of representation, as “how you spend your 9 to 5 is fair game.

“What you do with your time, with your energy, with your money, and all your values, is for voters to learn about, to judge and then to decide whether that's the kind of person that we want to lead us in Washington.”

Joe Bonilla, co-founder of creative strategy firm, Relentless Awareness, said “all is fair in politics and love.”

Bonilla, who works mostly for Democrats but also for Republicans and Independents, said the Rocha v. Alonzo case could challenge Flores’ campaign because “especially in Texas — Friday Night Lights and Texas high school football is a huge matter — that could very well certainly impact his chances.”

Mike Hahn, a Republican strategist and former Trump social media director, declined to comment on Flores' campaign.

Flores’ campaign priorities include supporting Trump and law enforcement, along with securing the border.

Lenchner said: “If you see someone who, out of one side of their mouth is saying, ‘I'm tough on crime, and I'm going to stand with the president on our America First agenda for law and order’ — and out of the other side of their mouth seems to be defending behavior that most voters would see as reprehensible, and frankly, in line with this disturbing trend of the Trump administration protecting predators — that's going to make a lot of difference.

“I think [it] will only not just reinforce those cynical feelings about politics generally, but specifically stand to really further damage the credibility and the authenticity of the candidate that's pushing out that kind of message.”

Just last week, Attorney General Pam Bondi sparred with lawmakers during a hearing about the Trump administration’s handling of investigative files related to Jeffrey Epstein, the financier and sex offender who killed himself in 2019.

Ultimately, “voters have a high BS-o-meter,” and can determine if a candidate’s actions align with their values, Lenchner said.

“Like you're defending in a courtroom, you need to be able to defend for your candidacy why that [case] was important for you to take at that time.”

Chris Gibbs (provided photo)

Chris Gibbs (provided photo)

Shontay Evans at a booth selling her plants through Tay's Secret Garden (provided photo)

Shontay Evans at a booth selling her plants through Tay's Secret Garden (provided photo) Shontay Evans at a protest at the Bishop Henry Whipple Federal Building on Jan. 21 (provided photo)

Shontay Evans at a protest at the Bishop Henry Whipple Federal Building on Jan. 21 (provided photo) U.S. District Court Judge Esther Salas with her son, Daniel Anderl, who was murdered in 2020 Courtesy Judge Salas

U.S. District Court Judge Esther Salas with her son, Daniel Anderl, who was murdered in 2020 Courtesy Judge Salas  Attorney and Speak Up for Justice founder Paul Kiesel (provided photo)

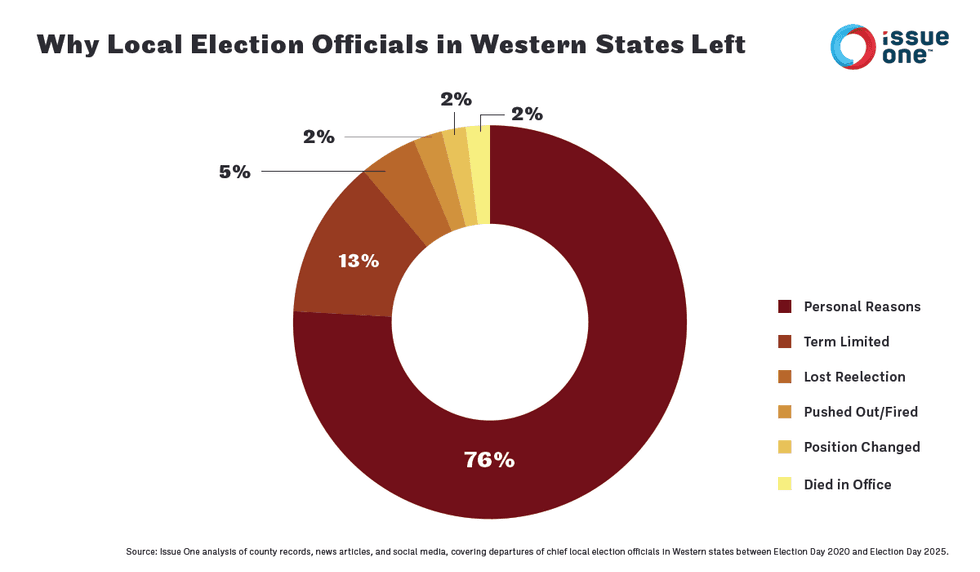

Attorney and Speak Up for Justice founder Paul Kiesel (provided photo) A new report revealed that 76% of local election officials in the Western U.S. left of personal reasons (Infographic from Issue One)

A new report revealed that 76% of local election officials in the Western U.S. left of personal reasons (Infographic from Issue One) Carly Koppes (provided photo)

Carly Koppes (provided photo) Amy Burgans (provided photo)

Amy Burgans (provided photo) Todd Howland (provided photo)

Todd Howland (provided photo) Daniel Pi (provided photo)

Daniel Pi (provided photo) Matthew Mangino (provided photo)

Matthew Mangino (provided photo) Ryan Marino (provided photo)

Ryan Marino (provided photo) David R. Shedd (provided photo)

David R. Shedd (provided photo) Andrew Badger (photo provided by David Shedd)

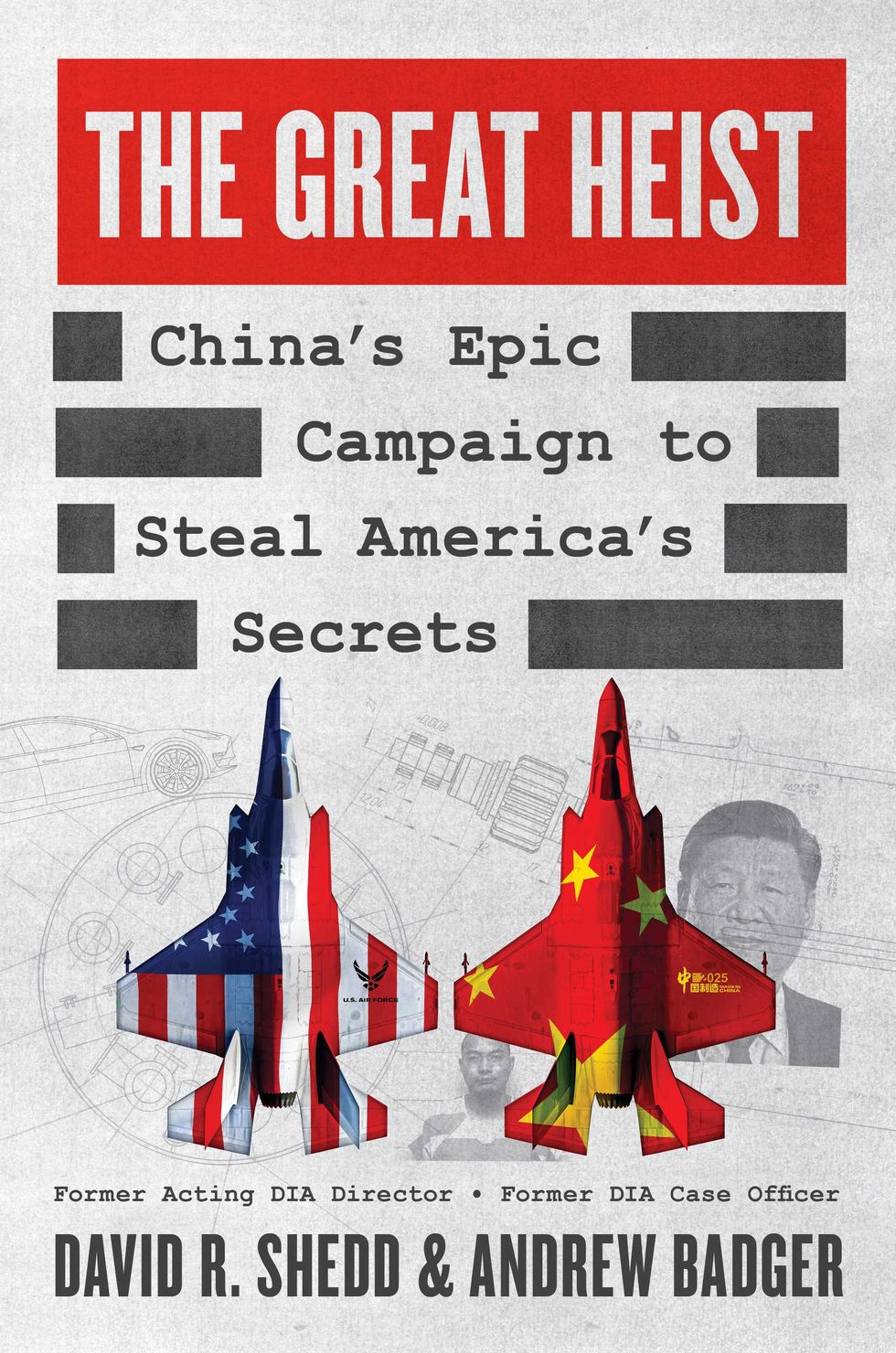

Andrew Badger (photo provided by David Shedd) The Great Heist (provided image)

The Great Heist (provided image) Ronn Easton (provided photo)

Ronn Easton (provided photo) Sen. Sheldon Whitehouse (D-RI) at Wednesday's hearing. Picture: Screengrab

Sen. Sheldon Whitehouse (D-RI) at Wednesday's hearing. Picture: Screengrab The Conspiracists (image provided by Broadleaf Books)

The Conspiracists (image provided by Broadleaf Books) Noelle Cook (photo provided by Broadleaf Books)

Noelle Cook (photo provided by Broadleaf Books) Seth Chandler (Photo credit: University of Houston Law Center)

Seth Chandler (Photo credit: University of Houston Law Center) FILE PHOTO: A view of the U.S. Supreme Court in Washington, U.S. June 29, 2024. REUTERS/Kevin Mohatt/File Photo

FILE PHOTO: A view of the U.S. Supreme Court in Washington, U.S. June 29, 2024. REUTERS/Kevin Mohatt/File Photo