At least 62 members of 118th Congress have violated a federal insider trading and conflicts-of-interest law, a Raw Story analysis of congressional financial disclosures reveals.

Most of these violations involve failures to properly disclose stock trades as required by the Stop Trading on Congressional Knowledge (STOCK) Act of 2012. Some involve not abiding by the transparency and personal financial disclosure requirements first outlined in the STOCK Act's post-Watergate predecessor, the Ethics in Government Act of 1978.

ALSO READ: 8 ways convicted felon Donald Trump doesn't become president

The most significant violator clocked in as much as six-and-a-half years late when reporting up to $8.5 million in stock transactions — Rep. Rick Allen (R-GA). Another lawmaker was just a couple days late but still logged up to $165,000 in late stock disclosures — Rep. John Curtis (R-UT). Between them are numerous other Republicans and Democrats alike who have consistently failed to abide by the STOCK Act.

The Obama-era law intends to stop insider trading, curb conflicts-of-interest and enhance transparency by requiring key government officials, including members of Congress, to publicly report within 45 days most purchases, sales and exchanges of stocks, bonds, commodity futures, securities and cryptocurrencies.

The excuses from the 2023-2024 violators are numerous:

“I mistakenly left it in draft” — Rep. Dan Bishop (R-NC)

“A clerical error” — Sen. Tom Carper (D-DE)

“Administrative error” — Rep. Kathy Manning (D-NC)

Website processing issues — Sen. Thom Tillis (R-NC)

Financial advisers are to blame — Rep. Zoe Lofgren (D-CA), Rep. Tom Kean Jr. (R-NJ) and Allen.

In an exclusive interview with Raw Story, one of the STOCK Act’s original authors, former Rep. Brian Baird (D-WA), blasted Congress for its continued excuses for failing to abide by the law.

“I mean, come on. ‘The dog ate my homework,’ aren’t we a little more grown up than that?” Baird said. “If we're capable of voting on whether or not to raise or lower taxes or send people to war, I think we can report when we make an investment.”

The standard fine for violating the STOCK Act is $200, but frequently the House Committee on Ethics and the Senate Select Committee on Ethics waive the fee.

Craig Holman, a Capitol Hill lobbyist on ethics and campaign finance rules for nonprofit Public Citizen, said the fee is one of two reasons why the STOCK Act is frequently violated.

ALSO READ: ‘Journalistic dystopian nightmare’: Inside a Tennessee college media meltdown

“The penalty is so minimal that these millionaire members of Congress really don't care about it," Holman told Raw Story. “The second provision is the ethics committees are not really enforcing it or taking it seriously.”

The steady stream of violations come at a time when a bipartisan group of lawmakers have introduced several similar bills aimed at banning congressional stock trading. For instance, the Ban Congressional Stock Trading Act, introduced by Sens. Jon Ossoff (D-GA) and Mark Kelly (D-AZ) in September 2023, would require members of Congress and their family members to divest from their stocks or place them a blind trust.

“Members of Congress should not be playing the stock market while we make federal policy and have extraordinary access to confidential information,” Ossoff said in a press release. “Stock trading by members of Congress massively erodes public confidence in Congress with serious appearance of impropriety, which is why we should ban stock trading by members of Congress altogether.”

The Ending Trading and Holdings in Congressional Stocks (ETHICS) Act, ultimately advanced out of the Senate Committee on Homeland Security and Governmental Affairs on July 24, which would immediately ban members of Congress from buying stocks and would prohibit them from selling stocks 90 days after enactment.

Members’ spouses and dependent children would be prohibited from trading stocks starting in March 2027, which is when the president and vice president would also be required to divest from covered investments, including securities, commodities, futures, options and trusts.

But that would require passage by both chambers and the president's signature in order for it to become law — something that's yet to happen.

Here are the 62 members of Congress (and counting) that Raw Story and other media organizations have identified as having violated the STOCK Act during 2023-2024:

Rep. Rick Allen (R-GA)

Rep. Rick Allen (R-GA) was as much as six-and-a-half years late in reporting 136 stock and other financial transactions totaling up to $8.56 million. (Source: U.S. House of Representatives)

Rep. Rick Allen (R-GA) was as much as six-and-a-half years late in reporting 136 stock and other financial transactions totaling up to $8.56 million. (Source: U.S. House of Representatives)

Allen was as much as six-and-a-half years late in reporting 136 stock and other financial transactions on an Aug. 10, 2023 disclosure — totaling between $3.05 million and $8.56 million. (Lawmakers are only required by law to disclose the values of their transactions in broad ranges.)

The stock transactions span dozens of companies such as defense contractor CAE Inc, energy companies Dominion Energy, General Electric, ExxonMobil, NextEra Energy and Phillips 66, technology companies such as Microsoft and Verizon, and mining company Freeport-McMo-Ran.

“Congressman Allen’s investment decisions are handled by a financial adviser, who uses investment managers to implement trades at their own discretion, without consulting with or getting input from the Congressman,” said Carlton Norwood Jr., a spokesperson for Allen. “In May of this year, Congressman Allen became aware of some reporting issues and omissions that were caused by a compliance firm he had engaged. At that point, he hired counsel and a new compliance firm to start working with the House Ethics Committee to ensure all trades have been properly reported.”

This is at least the third separate time Allen has violated the STOCK Act.

Raw Story reported in June that Allen was late in disclosing his spouse’s March 27 sale — valued between $100,001 to $250,000 — of stock in SouthState Corporation, a financial services company.

In 2021, Insider reported that Allen has several financial filing flubs related to his stock trade activity from 2019 and 2020.

Rep. Kelly Armstrong (R-ND)

Rep. Kelly Armstrong (R-ND) speaks alongside other House Oversight and Accountability Committee members in May. (Photo by Chip Somodevilla/Getty Images)

Rep. Kelly Armstrong (R-ND) speaks alongside other House Oversight and Accountability Committee members in May. (Photo by Chip Somodevilla/Getty Images)

Armstrong asked for, and received, a standard 90-day extension to file his 2022 annual financial disclosure report. He should have filed by Aug. 13, 2023. But he didn’t file until Sept. 8, making him one of 11 legislators who failed to file their 2022 annual reports on time, according to a Raw Story analysis of federal records and reporting from congressional research organization Legistorm.

When Armstrong did file, he reported earning royalties and working interest from hundreds of oil and gas wells, along with various mutual funds and rental properties.

Roll Call reported in 2019 that Armstrong earned at least $400,000 from the wells and as much as $1.1 million the previous year, along with a $75,000 salary from Armstrong Corp., his family’s oil and gas business, while serving on the House Select Committee on the Climate Crisis.

Armstrong’s latest report only shows that his wife earned a salary from BLST Operating Company LLC of an undisclosed amount.

Armstrong currently serves on the House Energy and Commerce Committee and its subcommittees on Energy, Climate and Grid Security; Innovation, Data and Commerce; and Oversight and Investigations.

He also serves on the House Select Subcommittee on the Weaponization of the Federal Government and the House Committee on Oversight and Accountability.

Armstrong’s congressional office did not respond to Raw Story’s request for comment.

Rep. Nanette Barragán (D-CA)

Barragán was nearly three months late reporting a purchase of U.S. Treasury bonds valued between $1,001 and $15,000.

Barragán reached out to the House Committee on Ethics about a new IRA roll-over account on March 27, Liam Forsythe, chief of staff for Barrágan told Raw Story via email.

"Upon opening the account she advised the independent manager she could not purchase or sell individual stocks. She was advised the account would be managed with mutual fund and exchange traded funds," Forsythe said. "Rep. Barragán noticed more activity than usual on a monthly statement and asked Ethics to review it for any guidance on reporting requirements."

During the review with the House Committee on Ethics, Barragán learned about two trades for Treasury bonds, which was "something Rep. Barragán has never purchased and was unfamiliar with," Forsythe said.

The House Committee on Ethics determined the trades were in an IRA roll-over but not in a fund, advising Barragán to file a report and to pay a "first-time late fee." which Barragán did immediately along with filing a fee waiver, Forsythe said.

Barragán was again late by four months on April 25 with disclosing another Treasury bond purchase, valued between $15,001 and $50,000.

Rep. Ami Bera (D-CA)

Rep. Ami Bera (D-CA) speaks during House Committee on Foreign Affairs testimony in March 2021. Ting Shen-Pool/Getty Images

Rep. Ami Bera (D-CA) speaks during House Committee on Foreign Affairs testimony in March 2021. Ting Shen-Pool/Getty Images

Bera was more than three months late in filing his 2022 annual financial disclosure report. He did not request an extension, meaning he should have disclosed his personal finances by May 15, 2023. He filed on Sept. 1.

Among other mutual funds and exchange traded funds, Bera reported owning up to $14 million in rental properties through a joint trust, along with up to $2.5 million in mortgages.

“Rep. Bera inadvertently missed the filing deadline. Upon realizing he was late, the congressman filed his financial disclosure and paid the associated late fees,” Travis Horne, communications director for Bera, told Raw Story via email.

Rep. Stephanie Bice (R-OK)

Bice reported two U.S. Treasury bill purchases as part of a joint trust from 2023, reported between nine months and a year late, according to U.S. House records. The purchases were each valued between $15,001 and $50,000.

Bice’s congressional office did not respond to Raw Story’s request for comment.

Rep. Dan Bishop (R-NC)

Rep. Dan Bishop (R-NC) was late reporting up to $5 million in Treasury notes. Win McNamee/Getty Images

Rep. Dan Bishop (R-NC) was late reporting up to $5 million in Treasury notes. Win McNamee/Getty Images

Bishop failed to properly disclose purchasing up to $5 million in U.S. Treasury notes, more than three months past the federal deadline.

The May 4, 2023 disclosure said, “The submittal of this report is late because I mistakenly left it in draft and failed to submit when originally posted in Dec. 2022.”

Bishop’s team confirmed this in a statement.

“When submitting PTRs in December for U.S. Treasury securities purchased, Congressman Bishop mistakenly omitted to press ‘submit’ for the last of the three filings. He submitted it immediately upon discovering the mistake, and regrets the error,” said Allie McCandless, a spokesperson for Bishop.

Sen. John Boozman (R-AR)

Sen. John Boozman (R-AR) was a day late reporting $30,000 in Treasury bond sales. Morris MacMatzen/Getty Images

Sen. John Boozman (R-AR) was a day late reporting $30,000 in Treasury bond sales. Morris MacMatzen/Getty Images

Boozman appeared to be in violation of the STOCK Act with a disclosure filed on Aug. 21, 2023, a day past the 45-day disclosure deadline. He reported up to $30,000 in Treasury bond sales and purchases.

Boozman appeared to violate the STOCK Act again on May 8 when he was more than a month late reporting four transactions involving U.S. Treasuries in exchange-traded funds. The transactions were each valued between $1,001 to $15,000.

Boozman’s congressional office did not respond to Raw Story’s requests for comment regarding either violation.

Sen. Tom Carper (D-DE)

Sen. Tom Carper (D-DE) violated the STOCK Act for the third time in 14 months. Drew Angerer/Getty Images

Sen. Tom Carper (D-DE) violated the STOCK Act for the third time in 14 months. Drew Angerer/Getty Images

For the third time in 14 months, Carper missed the 45-day disclosure deadline by being as much as two weeks late in reporting his spouse’s U.S. Treasury bill purchases and sales totaling up to $345,000, as well as a PayPal stock sale up to $15,000, according to a June 30, 2023 federal financial report.

“There was a clerical error,” Natasha Dabrowski, Carper’s communications director, told Raw Story. “Senator Carper is working with the Ethics Committee so he can fully resolve the matter.”

Raw Story reported in March that Carper was more than a year late in disclosing his wife Martha Ann Stacy’s $2,991.98 sale of stock in Taiwan Semiconductor Manufacturing Ltd. Carper, as chairman of the Senate Finance Subcommittee on International Trade, advocated for Taiwan's inclusion in the Indo-Pacific Economic Framework. Carper's team also indicated a "simple clerical error" at that time.

Carper was also months late in disclosing Stacy’s $1,124 sale of stock in international mining company, Barrick Gold Corp., in November 2021, Insider reported last year.

Rep. Buddy Carter (R-GA)

Carter was more than eight months late disclosing the sale of government securities for the Atlanta, Ga., Development Authority, valued between $15,001 and $50,000, as a subholding of brokerage and investment banking firm Stifel, according to a June 28 congressional filing.

Carter's congressional office did not respond to Raw Story's request for comment.

Rep. Sean Casten (D-IL)

Rep. Sean Casten (D-IL) was as much as two-and-a-half years late disclosing eight purchases of Myno Carbon Corp. stock. (Photo by Drew Angerer/Getty Images)

Rep. Sean Casten (D-IL) was as much as two-and-a-half years late disclosing eight purchases of Myno Carbon Corp. stock. (Photo by Drew Angerer/Getty Images)

Casten was as much as two-and-a-half years late in some cases in reporting eight purchases of Myno Carbon Corp. stock through a family investment vehicle.

Total value: between $127,008 and $380,000.

“These transactions were loans and equity investments made by Rep. Casten’s family investment firm, a company in which he holds a minority, non-controlling stake and has no active participation in,” Jacob Vurpillat, a spokesperson for Casten, told Raw Story. “Rep. Casten was unaware of the transactions until August 2023, at which point he proactively consulted with the House Ethics Committee to determine if they are subject to House financial disclosure rules.”

Casten disclosed the transactions “in the interest of providing as much transparency as possible to his constituents,” Vurpillat said, amending his 2021 and 2022 annual financial reports, along with filing a new transaction report on January 16.

Vurpillat said Casten has not been assessed a late fee.

“To be clear – Rep. Casten does not own individual stock, has not owned any during his time in Congress, and is a long-time supporter of the movement to ban members of Congress from trading individual stock,” Vurpillat told Raw Story via email.

Casten again appeared to violate the STOCK Act when he reported in August 2024 three purchases of corporate securities in carbon removal company, Myno Carbon Corporation, between two to eight months late.

The investments were valued between $30,003 and $115,000 total.

Vurpillat again emphasized that the transactions were made by a family investment firm, saying, “They were made by a family member without Rep. Casten’s prior knowledge. Upon learning of the transaction, he proactively consulted with the House Ethics Committee to determine how to best disclose them to the public.”

Rep. Mike Collins (R-GA)

Collins violated a the STOCK Act by reporting two Ethereum cryptocurrency purchases — each valued between $1,001 to $15,000 — as much as a month late.

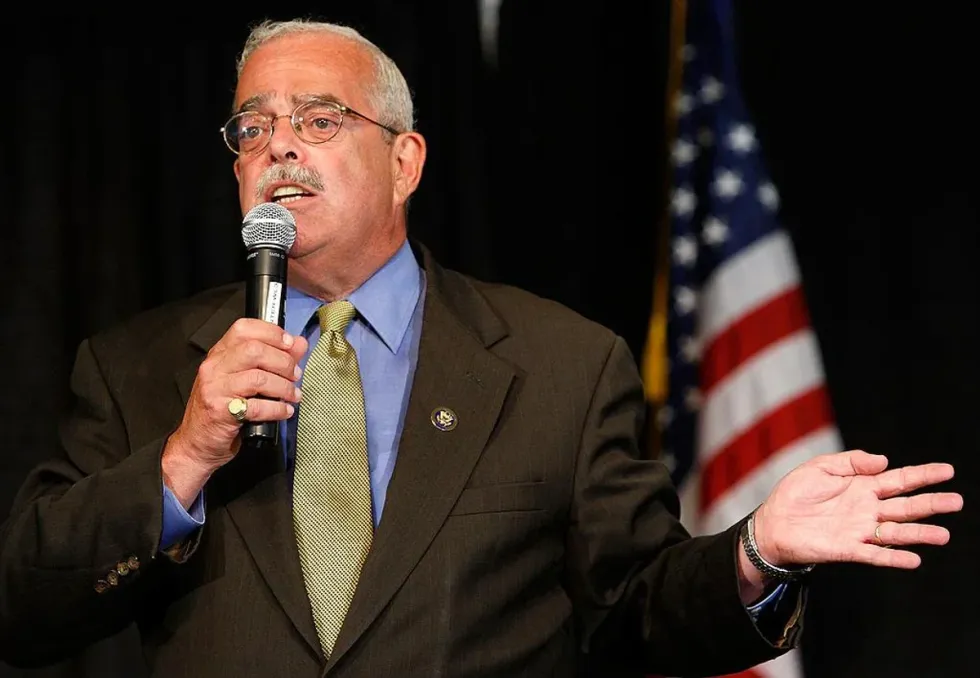

He made the purchases on Oct. 9 and Nov. 5, but he did not publicly report them until Dec. 22, missing the 45-day federal deadline. Collins properly reported on Dec. 22 two separate Ethereum purchases, each valued at up to $15,000. Collins' congressional office did not respond to Raw Story's requests for comment.Rep. Gerry Connolly (D-VA)

Rep. Gerry Connolly (D-VA) was late disclosing up to $80,000 in stocks. Alex Wong/Getty Images

Rep. Gerry Connolly (D-VA) was late disclosing up to $80,000 in stocks. Alex Wong/Getty Images

Connolly, who’s served as a senior member of the House Committee on Oversight and Accountability, was late disclosing three stock sales in power generation company Dominion Energy Inc., technology and engineering company Leidos and information technology firm Science Applications International Corporation, valued between $17,002 and $80,000, according to a Jan. 24 financial disclosure.

Connolly told Raw Story he submitted his digitally signed stock trade disclosure document several days late to the Clerk of the House of Representatives because his financial advisers were late notifying his wife, who files his congressional disclosure reports, about the stock sales.

Rep. John Curtis (R-UT)

Rep. John Curtis (R-UT) was two days late disclosing up to $165,000 in stock trades. George Frey/Getty Images

Rep. John Curtis (R-UT) was two days late disclosing up to $165,000 in stock trades. George Frey/Getty Images

Curtis was two days late disclosing 11 stock trades totaling between $11,001 and $165,000, according to an Aug. 7, 2023 federal disclosure. Curtis reported stock transactions in a handful of companies, including Coca-Cola, Microsoft, Sysco Corporation, T-Mobile, Valero Energy and semiconductor company Advanced Micro Devices.

“A law firm handles the preparation and filing of all periodic transaction reports for Congressman Curtis,” said Corey Norman, chief of staff to Curtis, in a statement. “The law firm filed the PTR on the business day following the report’s Saturday due date. A late fee is not typically assessed when a report is filed on the next business day and the law firm would address that as the responsible party if a minor fee is assessed.”

In mid-March, Curtis was one of five members of Congress who dumped their personal stock shares in now-defunct First Republic Bank, which at the time was bleeding stock value amid the meltdown of three regional banks, Raw Story reported.

Rep. Debbie Dingell (D-MI)

Rep. Debbie Dingell (D-MI) was late reporting up to $15,000 in Disney stock. Allison Shelley/Getty Images North America/TNS

Rep. Debbie Dingell (D-MI) was late reporting up to $15,000 in Disney stock. Allison Shelley/Getty Images North America/TNS

Dingell submitted a disclosure on May 15 reporting the purchase of $1,001 to $15,000 in Disney stock on Nov. 29.

“Congresswoman Dingell discovered the omission while filing her annual financial disclosure and acted immediately to rectify the issue by promptly filing a periodic transaction report,” said Michaela Johnson, a spokesperson for Dingell.

“She will continue to defer financial decisions to a financial adviser and has directed her office to proactively take measures to ensure this issue does not occur again,” Johnson said. “She will continue to support efforts in Congress to increase transparency and accountability, especially when it comes to trading stocks and financial portfolios.”

Dingell also purchased stock in medical devices technology company Medtronic while serving on House subcommittees with oversight on health and technology, Raw Story reported on Dec. 19, 2023.

Rep. Jeff Duncan (R-SC)

Duncan was more than seven months late in disclosing two stock sales in his individual retirement account, according to a congressional financial filing from May 23, 2024.

Duncan reported the sales of Colgate-Palmolive and JD.com stock, each valued between $1,001 to $15,000.

The report noted that the transactions were tax-deferred rollovers from Duncan's individual retirement account with Raymond James to a thrift savings plan.

"Due to balance requirement at Raymond James of $10,000, I was forced to sell the stocks and then I rolled the balance into my TSP via the TSP rollover process, never touching or having access to the funds," the report said.

Duncan's congressional office did not respond to Raw Story's multiple request for comment.

Rep. Ron Estes (R-KS)

Rep. Ron Estes (R-KS) was about four months late reporting up to $45,000 in Treasury bonds. Anna Moneymaker/Getty Images

Rep. Ron Estes (R-KS) was about four months late reporting up to $45,000 in Treasury bonds. Anna Moneymaker/Getty Images

Estes reported three April purchases of up to $45,000 in U.S. Treasury savings bonds on a Sept. 30 financial disclosure — about four months past the 45-day deadline.

Estes serves on the Committee on Ways and Means, Budget Committee, Education and the Workforce Committee and Joint Economic Committee. The Committee on Ways and Means oversees the country’s bonded debt.

Estes’s congressional office did not respond to Raw Story’s request for comment.

Sen. John Fetterman (D-PA)

Fetterman formally reported on Aug. 13, 2024, 30 corporate bond transactions and one stock sale made on behalf of his dependent children during 2023 — with the oldest transaction reported about 17 months after a federally mandated deadline.

An unidentified dependent child made a partial sale of stock in petroleum company Marathon Oil on Jan. 24, 2023, valued between $1,001 and $15,000.

The 30 corporate bonds include investments in a variety of companies, including multinational conglomerate General Electric, electric services company Florida Power and Light, petroleum company Phillips 66 Partners, steel producer Steel Dynamics and multinational financial services company, Bank of America.

The corporate bonds are valued between $58,030 and $430,000 total.

“Sen. Fetterman filed an amendment to his financial disclosures that included investments for his children that were created by generous grandparents who were unaware of the reporting requirements,” said a spokesperson for Fetterman’s campaign, who declined to be named. “Once Sen. Fetterman was made aware of the investments, he immediately filed the appropriate disclosures.”

Rep. Russ Fulcher (R-ID)

Rep. Russ Fulcher (R-ID) was more than a year late reporting a sale up to $15,000 of Banc of California stock. (Photo by Bonnie Cash-Pool/Getty Images)

Rep. Russ Fulcher (R-ID) was more than a year late reporting a sale up to $15,000 of Banc of California stock. (Photo by Bonnie Cash-Pool/Getty Images)

Fulcher reported on May 12, 2023, that he sold Banc of California stock shares worth between $1,001 to $15,000. The date of the sale was March 15, 2022, meaning his disclosure was more than a year late.

Fulcher’s team did not respond to multiple requests for comment.

Rep. Ruben Gallego (D-AZ)

Gallego appeared to violate the STOCK Act in August when he disclosed two transactions nearly two and five years late.

Gallego disclosed on Aug. 13, 2024 an August 2019 purchase of non-publicly traded stock in investment advisory, Aspiration Fund Adviser LLC, valued between $15,001 and $50,000.

Gallego also purchased corporate securities in pronunciation guide services company NameCoach Inc. in June 2022. This investment is also valued between $15,001 and $50,000.

"Rep. Gallego believes elected officials should be transparent and accountable to the people they represent, which is why he has co-sponsored legislation to clean up Washington and implement stricter disclosure requirements," said a spokesperson for Gallego, who declined to be named. "These investments were disclosed in previous filings and the recently filed report corrects inadvertent errors."

Rep. Sylvia Garcia (D-TX)

Rep. Sylvia Garcia (D-TX) speaks a news conference in October 2021 in Washington, DC. Chip Somodevilla/Getty Images

Rep. Sylvia Garcia (D-TX) speaks a news conference in October 2021 in Washington, DC. Chip Somodevilla/Getty Images

Garcia filed her 2022 annual disclosure on Sept. 12, 2023 after receiving a 90-day extension. She was about a month past her deadline.

“Due to an inadvertent internal miscommunication, the report was not filed by the due date of August 13. As soon as we discovered this error, Rep. Garcia filed the report, and we were in communication with the House Ethics Committee regarding the late filing. This matter was fully resolved upon the filing of the report,” said Chris McCarthy, Garcia’s deputy chief of staff, via email.

“Per the committee’s written guidance, there is a 30-day grace period before late fees are imposed, and this report was filed within that window.”

Garcia reported several mutual funds, three pensions totaling $114,112.08 and up to $265,000 in home debt.

“I do not manage any financial trades as I only have tax deferred 457 retirement accounts that exclusively contain mutual funds and other diversified funds. I do not buy, sell or trade stock or maintain a stock portfolio,” said Garcia in a statement shared with Raw Story.

Rep. Glenn Grothman (R-WI)

Rep. Glenn Grothman (R-WI) was more than a year late reporting up to $30,000 in Treasury bonds. (Photo by Anna Moneymaker/Getty Images)

Rep. Glenn Grothman (R-WI) was more than a year late reporting up to $30,000 in Treasury bonds. (Photo by Anna Moneymaker/Getty Images)

Grothman was more than a year late in reporting two purchases of U.S. Treasury Series I savings bonds totaling up to $30,000, according to a June 27, 2023, federal financial disclosure.

Grothman reported on May 14, 2024, three purchases of U.S. savings bonds, ranging from nearly two weeks to 14 months late. Each purchase was valued between $1,001 and $15,000.

Grothman’s office did not respond to multiple requests for comment.

Rep. Bill Hagerty (R-TN)

Sen. Bill Hagerty speaks on the at the CPAC Washington, DC conference on March 2, 2023 (Photo by Shutterstock/lev radin)

Sen. Bill Hagerty speaks on the at the CPAC Washington, DC conference on March 2, 2023 (Photo by Shutterstock/lev radin)

Hagerty reported a stock exchange in Crestwood Equity Partners LP on Nov. 6, 2023, about eight months after the 45-day deadline.

A note on Hagerty’s report said, “While no immediate [periodic transaction report] required, provided to clearly denote basis for the renamed asset on the 2023 annual report that was previously named CEQP.”

“Sen. Hagerty worked closely with the Senate Ethics Committee to properly document why this asset was renamed on his 2023 annual report in order to be fully compliant with the Committee’s rules. Here, there was no economic change—rather, the security involved is reflected under a different name on this year’s report as a result of a merger transaction," said Audrey Traynor, a spokesperson for Hagerty. "Sen. Hagerty did not purchase or sell the asset, but simply filed a periodic transaction report to clearly and transparently document the reason for the name change on the annual report.”

A Raw Story review of financial disclosures did not show a periodic transaction report — the formal name of a congressional financial disclosure for assets the STOCK Act mandates must be reported within 45 days of a transaction — previously filed for the asset.

Hagerty previously violated the STOCK Act in 2022, according to Business Insider. He also reported in 2022 that his four children are minority owners, alongside actress Reese Witherspoon and professional football player Derrick Henry, in Nashville’s major league soccer team.

Rep. Bill Huizenga (R-MI)

Rep. Bill Huizenga (R-MI) speaks at a House Financial Services Committee hearing in May. (Photo by Kevin Dietsch/Getty Images)

Rep. Bill Huizenga (R-MI) speaks at a House Financial Services Committee hearing in May. (Photo by Kevin Dietsch/Getty Images)

Huizenga filed his annual report 10 days late, on Aug. 23, after receiving a 90-day extension.

He reported up to $1.1 million in income from Huizenga Gravel Company and Huizenga Gravel LLC, which he owns with his cousin, according to The Detroit News. He also reported land ownership through Huizenga Development Land LLC, a rental property, mutual funds and ownership interests in health and wellness companies.

Huizenga’s congressional office did not respond to Raw Story’s request for comment.

Rep. Darrell Issa (R-CA)

Rep. Darrell Issa (R-CA) speaks during House Judiciary Committee field hearing on New York City violent crimes at Javits Federal Building in New York City on April 17, 2023(Photo by lev radin/Shutterstock)

Rep. Darrell Issa (R-CA) speaks during House Judiciary Committee field hearing on New York City violent crimes at Javits Federal Building in New York City on April 17, 2023(Photo by lev radin/Shutterstock)

Issa was late reporting 19 sales of U.S. Treasury bills, some more than six months late. The transactions are valued between $71 million and $355 million total.

Issa’s congressional office did not respond to Raw Story’s request for comment.

Rep. Jonathan Jackson (D-IL)

Rep. Jonathan Jackson (D-IL), left, was late in disclosing up to $300,000 in stock transactions. (Source: U.S. House of Representatives.)

Rep. Jonathan Jackson (D-IL), left, was late in disclosing up to $300,000 in stock transactions. (Source: U.S. House of Representatives.)

Jackson was late in disclosing up to $300,000 in stock transactions he made earlier this year, according to a disclosure he submitted on May 12.

“We announced that the filing was delayed, and we take this matter seriously. However, I want to emphasize that we are now in full compliance, and I've implemented measures to ensure timely filings in the future,” Jackson told Raw Story. “Setting up the new office, we've changed a compliance officer, and that contributed to the delay, so very comfortable with our team now.”

Jackson disclosed four January stock purchases, ranging from $15,001 to $50,000 each, for electronics manufacturer AMETEK Inc., Deere & Company, Parker-Hannifin Corporation and Visa.

On Feb. 28, he purchased $15,001 to $50,000 in Brighthouse Financial Inc. stock and sold UnitedHealth Group stock in the same price range.

Rep. Sheila Jackson Lee (D-TX)

Rep. Sheila Jackson Lee (D-TX) speaks during a House Committee on Oversight and Reform hearing in June 2022. (Photo by Andrew Harnik-Pool/Getty Images)

Rep. Sheila Jackson Lee (D-TX) speaks during a House Committee on Oversight and Reform hearing in June 2022. (Photo by Andrew Harnik-Pool/Getty Images)

Jackson Lee filed her annual report on Oct. 4, 2023, nearly two months after her extended deadline of Aug. 13. She had asked for a 90-day filing extension in May.

On Jackson Lee’s handwritten financial disclosure report, she reported up to $1 million in home debt, along with retirement accounts and a pension from the City of Houston that is yet to be received.

Despite a stamp from the Legislative Resource Center indicating that her report was filed Oct. 4, Jackson Lee's congressional team denied that she was out of compliance with the law.

“Congresswoman Sheila Jackson Lee filed her financial disclosure forms in compliance with all rules and regulations established for members in filing these financial forms,” Lillie Coney, chief of staff and spokesperson for Jackson Lee, told Raw Story via email. “The member is and was in compliance with the filing of this year's financial disclosure form and all others. All other inquiries are not applicable to the member.”

Raw Story asked Jackson Lee’s office — and all legislators with violations — questions about her office's contact with the House Committee on Ethics, compliance with training for financial disclosures and responsibility for management of any investments.

An email from Coney indicated that "investments are not managed by the member."

Rep. John James (R-MI)

Rep. John James (R-MI) at the Republican National Convention on July 15 (Photo by Maxim Elramsisy/Shutterstock)

Rep. John James (R-MI) at the Republican National Convention on July 15 (Photo by Maxim Elramsisy/Shutterstock)

James failed to disclose 145 stock trades on time, The Detroit News reported. The oldest transactions reported by James on Sept. 2 were from November 2023, disclosed more than eight months past the federal deadline.

Campaign finance reform political action committee, End Citizens United, filed a complaint against James with the House Committee on Ethics about the late transactions valued up to $2.2 million total.

“Rep. James kept the public in the dark on millions of dollars of stock trades and his own personal finances and must be held accountable,” said Tiffany Muller, president of End Citizens United, in a press release. “His blatant disregard for the law, which he is clearly well aware of, is unacceptable and shows he cannot be trusted.”

James was also nearly three months late disclosing an April 25, 2024 trade of TJX stock on his Sept. 6 financial disclosure.

James’ congressional office did not respond to Raw Story’s request for comment.

Rep. David Joyce (R-OH)

Joyce reported on Aug. 6 a dozen stock transactions after the 45-day deadline required by the STOCK Act with three of the transactions dating back to July 2022, reported nearly two years late. The rest are from June 2023, reported a year late. The transactions are valued between $138,012 and $495,000 total.

Investments include stock in aerospace corporation Boeing, multinational investment bank Citigroup, private credit manager Golub Capital and energy company TC Energy Corporation. Some investments are part of a trust, others from a retirement account.

Joyce's congressional office did not respond to Raw Story's request for comment.

Rep. Marcy Kaptur (D-OH)

Rep. Marcy Kaptur (D-OH) sold $1,280.03 worth of stock in The Andersons, Inc, reporting it five months late. Anna Moneymaker/Getty Images

Rep. Marcy Kaptur (D-OH) sold $1,280.03 worth of stock in The Andersons, Inc, reporting it five months late. Anna Moneymaker/Getty Images

Kaptur submitted a disclosure on May 15 that revealed she sold $1,280.03 worth of stock in The Andersons, Inc. — an agriculture supply company.

She made the sale on Oct. 21, 2023, meaning her disclosure was more than five months late.

“In 38 years of filing congressional disclosure reports, Congresswoman Kaptur has never purchased or traded individual stocks,” said Ben Kamens, communications director for Kaptur. “When her brother passed away in 2021, she inherited her first individual stocks and fully disclosed she would hold and not trade them.”

Kamens continued, “In 2022, it became clear that as a result of redistricting Congresswoman Kaptur would represent the Ohio agribusiness whose stock she had inherited. To avoid even the appearance of any conflict with her official work, Congresswoman Kaptur promptly sold all of her shares in the stock.”

Rep. Tom Kean Jr. (R-NJ)

Rep. Tom Kean Jr. (R-NJ) was up to four months late disclosing six stock transactions. Jeff Fusco/Getty Images

Rep. Tom Kean Jr. (R-NJ) was up to four months late disclosing six stock transactions. Jeff Fusco/Getty Images

Rep. Tom Kean Jr. (R-NJ) violated the STOCK Act when, on Sept. 18, 2023, he was as much as four months late disclosing six personal stock transactions, totaling up to $90,000.

Kean reported stock purchases in metal can manufacturing company Crown Holdings, medical and industrial conglomerate Danaher Corporation and financial services companies Fidelity National Information Services and JP Morgan Chase. He also reported two stock sales in Fidelity and financial technology company Global Payments, Inc., as a part of the Kean Family Partnership.

“Upon taking office, I hired professionals to make certain that any and all transactions that I have control or interest in are reported accurately and quickly,” Kean himself told Raw Story via a statement. “However, this week, the attorney charged with overseeing my personal transaction reporting for the House shared with me that transactions from a family trust account, which I have no control over, were shared with him in an untimely fashion despite regular check-ins and confirmation of accurate reporting.”

Kean was particularly critical of former Rep. Tom Malinowski (D-NJ) who he beat out for the congressional seat and who also violated the STOCK Act.

Kean appeared to again violate the STOCK Act in August 2024 and September 2024 when he was more than nine months late disclosing the sale of an asset in New Jersey bank, Regal Bancorp, and four days late disclosing stock in industrial technology conglomerate, Fortive.

Of the late September 2024 filing, Dan Scharfenberger told Raw Story via email, "This filing is not late but instead is within the grace period established by the Ethics Committee for just such purposes.".

A Jan. 2023 memo from the House Committee on Ethics indicates that a financial disclosure filed after the 45-day deadline is still late, but the standard $200 fine will not be immediately assessed.

"A PTR is late if submitted any time after the due date, but there is a 30-day grace period before late fees are imposed," the memo says.

Rep. Mike Kelly (R-PA)

Rep. Mike Kelly (R-PA) was late in reporting that his wife a made a March 2024 stock purchase in steel manufacturer Cleveland-Cliffs that was nearly identical to a stock transaction that resulted in a 2021 ethics investigation into insider trading, The Erie Times-News reported.

Kelly also missed the 45-day deadline disclosing 10 other stock transactions from his wife, according to a June 14 financial disclosure report.

An October 2021 Office of Congressional Ethics report said there was "substantial reason to believe" his wife, Victoria Kelly, profited on a $15,001 to $50,000 stock purchase in Cleveland-Cliffs by using "confidential information" she learned through her husband, according to Business Insider.

Separately, Business Insider reported in September 2021 that Kelly violated the STOCK Act by failing to properly disclose a stock trade made by his wife.

Sen. Angus King (I-ME)

King was as much as two weeks late in disclosing two of his spouse’s early-November sales of municipal securities, with a total value between $16,002 to $65,000.

“With the filing deadline falling over a long holiday weekend – as it does from time to time – it was submitted as soon as our point person logged on this morning,” Matthew Felling, a spokesperson for King, told Raw Story on Jan. 2. “Senator King and his wife keep their own financial counsel and do not consult each other on investments.”

Felling said the U.S. Senate Select Committee on Ethics had not been in touch with King’s team. King is a co-sponsor of the Ending Trading and Holdings In Congressional Stocks (ETHICS) Act, one of several bills introduced by a bipartisan group of lawmakers aimed at banning congressional stock trading.Rep. Darin LaHood (R-IL)

Rep. Darin LaHood spoke about government funding and President Biden's meeting with Chinese President Xi. (C-SPAN)

Rep. Darin LaHood spoke about government funding and President Biden's meeting with Chinese President Xi. (C-SPAN)

LaHood reported a November 2022 sale of stock in West Suburban Bancorp more than 20 months late.

The trade was valued between $1,001 and $15,000. (Lawmakers are only required by law to disclose the values of their transactions in broad ranges.)

LaHood’s congressional office did not immediately respond to Raw Story’s request for comment.

Rep. Doug Lamborn (R-CO)

Lamborn was over a week late disclosing three purchases of stock in data company NetApp through an individual retirement account. The purchases were each valued between $15,001 and $50,000.

Lamborn also violated the STOCK Act in 2022, Business Insider reported. Lamborn’s congressional office did not respond to Raw Story’s request for comment.

Rep. Greg Landsman (D-OH)

Rep. Greg Landsman (D-OH) speaks at a House session on Sept. 20, 2024 where legislation passed that would provide presidential candidates with the same level of Secret Service protection as the president. (C-SPAN)

Rep. Greg Landsman (D-OH) speaks at a House session on Sept. 20, 2024 where legislation passed that would provide presidential candidates with the same level of Secret Service protection as the president. (C-SPAN)

Landsman reported 91 late stock trades from his spouse and a joint trust, some going back to January 2023.

The investments are valued between $203,091 and $1.645 million total. Companies invested in include e-commerce giant Amazon, oil and natural gas company Diamondback Energy, cybersecurity company CrowdStrike, pharmaceutical company Eli Lilly and artificial intelligence company Nvidia, to name a few.

“As soon as Greg learned of the transactions, he immediately reported them,” said Alexa Helwig, communications director for Landsman.

Rep. Zoe Lofgren (D-CA)

Rep. Zoe Lofgren (D-CA), right, was late in disclosing up to $265,000 in her husband's stock sales. Chip Somodevilla/Getty Images

Rep. Zoe Lofgren (D-CA), right, was late in disclosing up to $265,000 in her husband's stock sales. Chip Somodevilla/Getty Images

Lofgren, who last year led Democratic House leadership’s self-aborted effort to ban congressional stock trading, was late in reporting her husband’s partial March 23 sale in software company Deskworks Inc. stock, valued between $100,001 to $250,000, on a May 15 federal disclosure.

She was also late in disclosing her husband’s sale of $1,001 to $15,000 worth of Expedia Group stock on August 25, 2022.

“All of these transactions, which are related to my husband’s solo practice retirement accounts, are managed by a financial adviser. I do not know about them until they are reported. If there is a late fee owed, it will be paid,” Lofgren told Raw Story in a statement.

Rep. Stephen Lynch (D-MA)

Lynch was more than three months late in reporting on May 9 his sale of stock in VMware, valued between $1,001 to $15,000., as a part of an individual retirement account.

A note on the May 9 report said that semiconductor and software company Broadcom Inc. acquired VMware.

"Broadcom Inc. re-purchased all VMware Class A stock holdings from portfolios that had less than a 100 shares. The total proceeds for the VMware stock re-purchase were deposited int he IRA Morgan Stanley Money Market Fund as reported on Schedule A," the report said.

Molly Rose Tarpey, a spokesperson for Lynch, said "there is a waiver request out to the Ethics Committee about the late filing and reason behind it." Lynch was still waiting to hear back from the House Committee on Ethics as of May 15.

"This wasn’t a buyer’s sale transaction, it was a corporate transaction. Congressman Lynch did not initiate the sale of the stock," Tarpey told Raw Story via email. "In fact, for as long as he’s held this IRA, he has never engaged in any intentional transaction. This was the result of a forced sale of stock that occurred when the company that Rep. Lynch owned 12 shares of was acquired by another company."

Tarpey continued, "Rep. Lynch had no control over this sale transaction. By the time Rep. Lynch became aware of the forced sale, the deadline had passed. The information was transmitted to the party responsible for submitting the [periodic transaction report] as soon as Rep. Lynch became aware of the need to do so."

Tarpey emphasized that Lynch "does not trade individual stocks," and the transaction was "an involuntary transfer of ownership" due to the acquisition.

"Lynch has not purchased individual stocks since he became a member of Congress in 2001, which was 11 years before the passage of the STOCK Act," Tarpey said, adding that Lynch supported the STOCK Act and similar legislation.

Lynch again appeared to violate the STOCK Act when he reported on Aug. 7, 2023 six sale transactions and one purchase for mutual funds as part of a retirement account, disclosed three weeks late. The transactions’ values ranged between $397,007 and $930,000 total.

Rep. Nicole Malliotakis (R-NY)

Rep. Nicole Malliotakis (R-NY) was late in disclosing two stock transactions up to $30,000. Drew Angerer/Getty Images

Rep. Nicole Malliotakis (R-NY) was late in disclosing two stock transactions up to $30,000. Drew Angerer/Getty Images

Malliotakis reported two stock transactions from Jan. 6, 2022, on her Aug.11 disclosure report — one for the purchase of AT&T stock in the $1,001 to $15,000 range and one for the sale of General Electric stock in the same range.

Her congressional office did not respond to Raw Story’s request for comment.

Rep. Kathy Manning (D-NC)

Rep. Kathy Manning (D-NC) appears to have violated the STOCK Act again by failing to disclose a stock purchase for more than a year. Anna Moneymaker/Getty Images

Rep. Kathy Manning (D-NC) appears to have violated the STOCK Act again by failing to disclose a stock purchase for more than a year. Anna Moneymaker/Getty Images

Rep. Kathy Manning (D-NC) reported purchasing $29,122 worth of stock in investment management company Blackstone Inc. on June 10, 2022, jointly with her husband — more than a year late, according to an Aug. 2 federal filing.

“The purchase was inadvertently omitted due to an administrative error. The error was discovered during preparation of the 2022 Annual Report for timely filing on August 2, 2023,” read a description on Manning’s filing.

This is Manning’s second known STOCK Act violation. Sludge reported in February 2022 that Manning and her husband failed to properly report 51 trades totaling between $275,000 and $1.25 million.

Manning’s congressional office did not respond to Raw Story’s request for comment.

Rep. Michael McCaul (R-TX)

Rep. Michael McCaul speaks during a House session on Sept. 25, 2024, where a suspension bill to fund the government beyond the September 30 deadline until December 20, 2024 was approved. (C-SPAN)

Rep. Michael McCaul speaks during a House session on Sept. 25, 2024, where a suspension bill to fund the government beyond the September 30 deadline until December 20, 2024 was approved. (C-SPAN)

McCaul was a day late in disclosing six transactions from a spouse and dependent child on Sept. 16, valued between $218,006 to $595,000 total.

Elliot Berke, attorney for McCaul, told Raw Story via an email statement, that all reports for the congressman were filed on time "to the best of our knowledge," and no fees had been assessed.

"I am in contact with the House Ethics Committee, which appreciates the complexity of Congressman McCaul’s financial disclosure given the volume of trades in his spouse’s and children’s managed accounts. If any amendments are required, they will be filed in consultation with the Ethics Committee. I am in touch with the House Ethics Committee on a proactive basis to ensure strict compliance," Berke said. "Congressman McCaul did not purchase these stocks and had no advanced knowledge of the purchase. Rather, his wife has assets she solely owns, and a third-party manager made the purchases without her direction.".

Rep. Cathy McMorris Rodgers (R-WA)

Rep. Cathy McMorris Rodgers was late disclosing up to $300,000 in community bond purchases. Anna Moneymaker/Getty Images

Rep. Cathy McMorris Rodgers was late disclosing up to $300,000 in community bond purchases. Anna Moneymaker/Getty Images

McMorris Rodgers reported on her Aug. 11 federal disclosure a Dec. 2, 2022, purchase for the Deep Roots Campaign, a community bond in a private K-12 school, valued between $100,001 and $250,000, along with another such bond purchase on May 12, for between $15,001 and $50,000.

Her congressional office did not respond to Raw Story’s request for comment.

Rep. Jared Moskowitz (D-FL)

Moskowitz disclosed on Aug. 6 more than 60 stock transactions from an account for a dependent child. Ten of those transactions were from February 2024, reported nearly five months late.

The tardy stocks include investments in companies ranging from health insurance provider Elevance Health to personal care multinational corporation Kimberly-Clark to footwear giant Nike and manufacturing company Snap-on. The value of the 60 investments are each in the $1,001 to $15,000 range.

Later that month Moskowitz violated the STOCK Act again by filing another late financial disclosure for 83 stock transactions, many dating back to July 2023, nearly a year past a federally mandated deadline.

The trades are valued between $224,083 and $1.585 million total, including investments in a wide variety of companies such as Google parent company Alphabet, tech giant Apple, oil and gas corporation Exxon Mobil, aerospace and defense manufacturer Lockheed Martin, energy company NextEra Energy and pharmaceutical company Pfizer. (Lawmakers are only required by law to disclose the values of their transactions in broad ranges.)

Lale M. Morrison, chief of staff for Moskowitz, told Raw Story in an emailed statement, that a law firm conducts monthly monitoring of Moskowitz’s investment accounts and prepares periodic transaction reports, the formal name of a congressional financial disclosure for assets that the STOCK Act mandates must be reported within 45 days of a transaction.

“While preparing the annual financial disclosure report for calendar year 2023, the law firm noticed they had lost access to one of the Morgan Stanley accounts. It appears the issue was the result of a back-end technical error,” Morrison said. “Upon access being restored, the law firm noticed reportable transactions in the account and immediately added the relevant transactions to the congressman’s annual financial disclosure report for calendar year 2023 and prepared a late [periodic transaction report], which was filed on August 21, 2024."

Moskowitz did not provide “any input or direction” on the investments, and an “independent financial manager” made the trades, Morrison said. Even if they use an outside financial manager, members of Congress are personally responsible for adhering to the provisions of the STOCK Act.

Rep. Seth Moulton (D-MA)

Rep. Seth Moulton (D-MA) was late disclosing up to $115,000 in stock transactions. Anna Moneymaker/Getty

Rep. Seth Moulton (D-MA) was late disclosing up to $115,000 in stock transactions. Anna Moneymaker/Getty

Moulton reported on Jan. 27 that his wife in September sold up to $100,000 worth of stock in gaming company Activision Blizzard and in August purchased up to $15,000 worth of stock in Amazon.com.

A spokesperson for Moulton, who's served in Congress since 2015, told Raw Story that the late disclosure was a "mistake" that the congressman will immediately rectify.

“Like a lot of families with two working spouses, the congressman’s family finances can sometimes be complex," Moulton spokesperson Sydney Simon said in an email. "A portion of his wife’s salary is paid in stocks, which they occasionally sell. They have sought guidance on this from both the Ethics Committee and outside counsel to ensure that they’re following all current rules. This particular instance, while a bit embarrassing, is simply a mistake — a deadline oversight that was quickly rectified when caught. Congressman Moulton will be paying the late fee when he gets to Washington later today.”

Rep. Dan Newhouse (R-WA)

Rep. Dan Newhouse (R-WA), center at lectern, was late disclosing up to $765,000 in personal stock transactions. Alex Wong/Getty Images

Rep. Dan Newhouse (R-WA), center at lectern, was late disclosing up to $765,000 in personal stock transactions. Alex Wong/Getty Images

Newhouse failed to properly report up to $765,000 in personal stock transactions, in some cases reporting a year-and-a-half late.

Newhouse reported 61 separate stock transactions on a May 26 financial disclosure, each in the $1,001 to $15,000 range.

Only 10 of the transactions were in compliance with the STOCK Act’s reporting deadlines. Newhouse disclosed stock purchases and sales across a variety of industries, including tech, financial services, agriculture, pharmaceutical and energy companies such as Apple, Tesla, Citigroup, Deere & Company, Eli Lilly and Company, Marathon Petroleum and NextEra Energy.

“In reviewing their finances, the congressman’s spouse noticed an oversight in her filing and took immediate steps to rectify it as soon as possible,” Mike Marinella, Newhouse’s press secretary, said in a statement to Raw Story. “The congressman and his family have always been and will continue to be fully transparent about their finances which is why it was corrected immediately.”

Del. Stacey Plaskett (D-VI)

Del. Stacey Plaskett (D-VI) speaks during a hearing of the Weaponization of the Federal Government subcommittee in February. Chip Somodevilla/Getty Images

Del. Stacey Plaskett (D-VI) speaks during a hearing of the Weaponization of the Federal Government subcommittee in February. Chip Somodevilla/Getty Images

Plaskett, a non-voting delegate from the U.S. Virgin Islands, filed her annual financial disclosure report on Aug. 29, making her more than three months late. She did not ask for a filing extension, meaning her deadline was May 15.

Like House Speaker Mike Johnson (R-LA), Plaskett reported no assets on her annual report. Plaskett reported two sources of spousal income in undisclosed amounts, along with a reporting a $10,000 to $15,000 income tax liability and a graduate student loan between $100,001 and $250,000.

“She recently lost her father and has been very busy settling her widowed mother,” Tionee Scotland, a spokesperson for Plaskett, sent in a text message to Raw Story. “The congresswoman missed the deadline, but has since filed as you can see.”

Rep. Mark Pocan (D-WI)

Pocan was as much as 22 months late reporting the purchases of two U.S. Treasury I Bonds for $20,000 each through a joint trust.

The House Committee on Ethics Committee noticed a periodic transaction report was missing for the purchase of bonds on March 30, 2022, which were reported on Pocan's 2022 annual report, Glenn Wavrunek, chief of staff for Pocan, told Raw Story via email.

Pocan also reported a secondary purchase of I bonds on Jan. 21, 2023, which will also appear on his 2023 annual report, Wavrunek said.

"The congressman also submitted a waiver to the Committee for both purchases since he was not aware that a [periodic transaction report] was required when purchasing US Treasury Bonds," Wavrunek said.

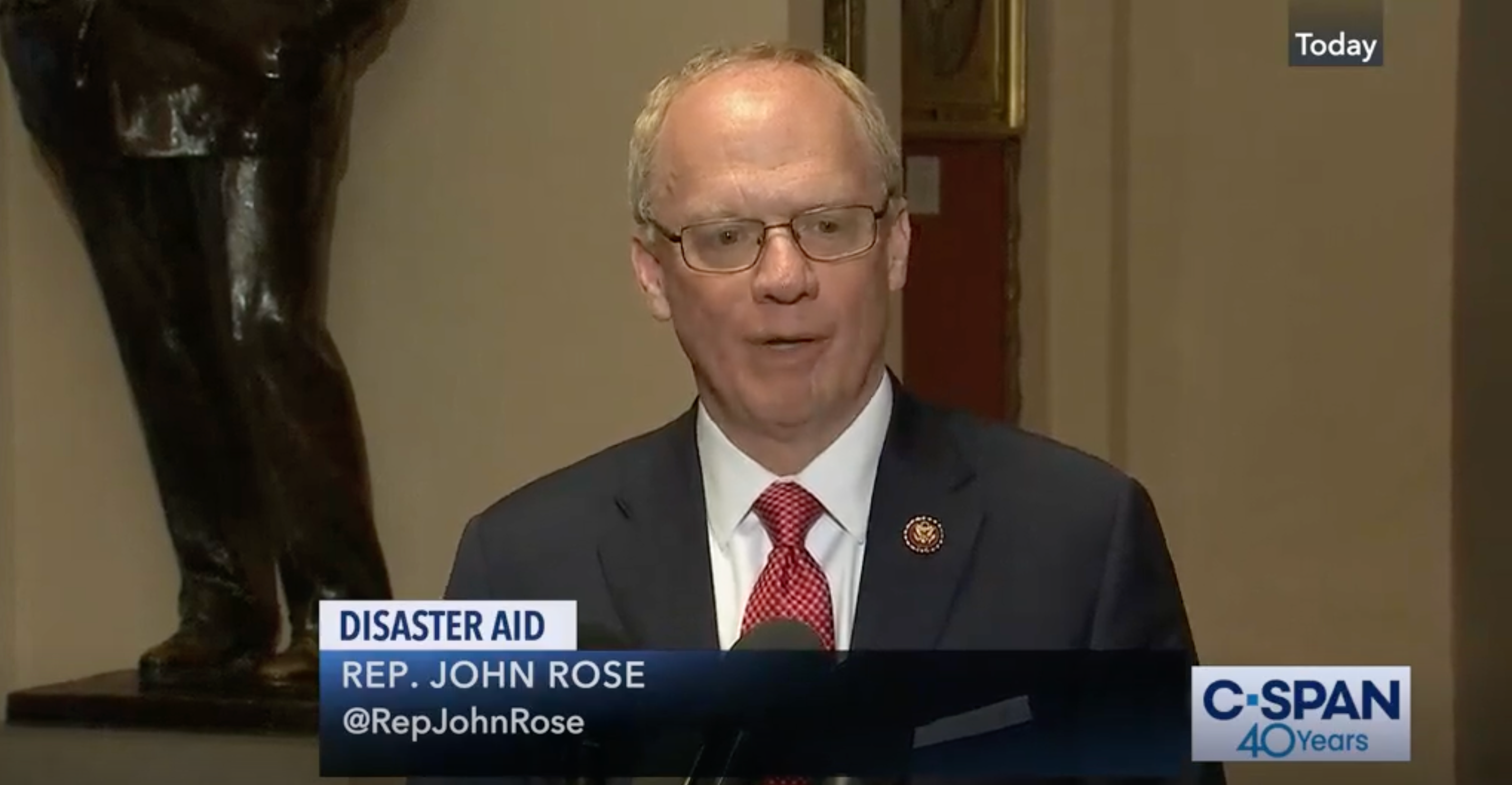

Rep. John Rose (R-TN)

Rep. John Rose (R-TN) spoke with reporters about blocking a $19.1 billion disaster relief bill in May 2019. C-SPAN

Rep. John Rose (R-TN) spoke with reporters about blocking a $19.1 billion disaster relief bill in May 2019. C-SPAN

Rose, one of the top 25 richest members of Congress, filed his annual financial disclosure report on Sept. 12, a month late.

In May, he had asked for, and received, a 90-day filing extension, meaning his deadline was Aug. 13.

Rose reported income as a limited partner in an entity that owns multi-family residential developments. He also reported a loan to his congressional campaign worth up to $5 million. (Lawmakers are only required to disclose most financial transactions in broad ranges.)

“Filing my financial disclosure form on or before August 15 each year is problematic because I do not receive necessary information applicable to my financial disclosure until after that date,” Rose said in a statement to Raw Story. “I have spoken to the House Ethics Committee about this ongoing problem and believe reform is necessary to give members like me with financial investments and/or who own small businesses the time to accurately complete this disclosure form within the statutory deadline.”

Rose also reported farm real estate owned in a trust and up to $6.1 million in stock in community banks. He reported stock investments, too, including up to $500,000 in Alphabet, the parent company of Google, and up to $750,000 in Microsoft.

“The current disclosure deadline disregards the fact that the IRS tax filing deadline for businesses is September 15, and the filing deadline for individuals is not until October 15 each year,” Rose said. “Consequently, I routinely do not have the necessary information to accurately comply with the financial disclosure requirements in a timely manner. I always attempt to provide accurate and complete information regarding my financial assets, of which the vast majority were earned before I was elected to Congress.”

Rose serves on the House Financial Services and House Agriculture Committees.

Rep. Deborah Ross (D-NC)

Ross disclosed on May 14 her spouse’s Nov. 7 exchange of Unity Software stock. Value: somewhere between $1,001 and $15,000.

“This transaction was a stock exchange that resulted from the merger of Unity Software and ironSource, a technology company,” said Josie Feron, a spokesperson for Ross’s office. “While Congresswoman Ross’ husband held Unity stock through his Roth IRA, he did not direct the transaction, and she reported it as soon as she became aware that it had occurred."

Rep. Maria Elvira Salazar (R-FL)

Rep. Maria Elvira Salazar (R-FL) appeared to have violated the STOCK Act again in May. Chip Somodevilla/Getty Images

Rep. Maria Elvira Salazar (R-FL) appeared to have violated the STOCK Act again in May. Chip Somodevilla/Getty Images

Salazar was a few days late in disclosing her spouse’s $1,001 to $15,000 sale of stock in Florida renewable energy company, NextEra Energy Partners on a May 31 financial disclosure.

While the trade itself wasn't particularly large, the congresswoman has been notably outspoken about STOCK Act violations, publicly shaming her political rival, then-Rep. Donna Shalala (D-FL), for failing to disclose stock trades on time.

It also wasn’t Salazar’s first STOCK Act slip-up: Just last year, Insider reported that Salazar was more than two months late in disclosing $500,000 in stock of senior healthcare services company, Cano Health Inc.

Salazar’s congressional office acknowledged receipt of Raw Story’s questions related to the lawmaker’s apparent STOCK Act violation, but representatives for Salazar have not otherwise responded to multiple requests for comment.

Rep. George Santos (R-NY)

Rep. George Santos (R-NY) leaves a GOP caucus meeting in January. Anna Moneymaker/Getty Images North America/TNS

Rep. George Santos (R-NY) leaves a GOP caucus meeting in January. Anna Moneymaker/Getty Images North America/TNS

Santos, who the U.S. House expelled in December, has yet to file his annual financial disclosure report, originally due May 15. He received an extension until Aug. 13.

The House Committee on Ethics shared a statement and report from the House Investigative Subcommittee that unanimously concluded there was substantial evidence that Santos used his “campaign committee to file false or incomplete reports with the Federal Election Commission; used campaign funds for personal purposes; engaged in fraudulent conduct in connection with RedStone Strategies LLC; and engaged in knowing and willful violations of the Ethics in Government Act as it relates to his Financial Disclosure (FD) Statements filed with the House.”

The report indicated that Santos was sent a letter on Sept. 13 from the committee’s financial disclosure office informing him that he owed a $200 late filing for not filing his financial disclosure statement on time.

On the same day, Santos’ counsel informed the committee he hadn’t filed his 2022 tax returns yet, causing him to miss the filing deadline for his annual report.

The committee urged Santos to file immediately, sending subsequent letters on Sept. 27 and Oct. 20, according to the report.

“The October 20 letter was deemed a ‘final notice’ that if his 2023 FD Statement was not filed by October 27, 2023, the Committee would ‘take action, not inconsistent with section 104 of the [Ethics in Government Act], as it deems appropriate.’ On October 24, 2023, counsel informed the [investigative subcommittee] that Representative Santos paid the $200 late-filing fee, and would be filing his 2023 FD Statement — which Representative Santos has still failed to do,” the report said.

Raw Story previously reported on Santos’ failure to file in August when he bashed his stock-trading colleagues on X, saying, “One thing I’m certain of is that members of congress trading stocks is imoral [sic]!”

“I said I wouldn’t trade and I’m keeping that promise,” he continued.

In October, the Department of Justice announced a 23-count superseding indictment charging Santos with alleged wire fraud, aggravated identity theft, money laundering, making materially false statements to the House, among others.

Santos has continued to ignore federal filing deadlines, even after being booted from office.

Rep. John Sarbanes (D-MD)

Rep. John Sarbanes (D-MD) was nearly a year late disclosing up to $30,000 in Treasury bonds. Drew Angerer/Getty Images

Rep. John Sarbanes (D-MD) was nearly a year late disclosing up to $30,000 in Treasury bonds. Drew Angerer/Getty Images

Sarbanes was nearly a year late in disclosing two purchases of U.S. Treasury bonds in June 2022, both in the $1,001-to-$15,000 range.

“Congressman Sarbanes had never purchased Treasury securities and was unfamiliar with the protocol, but he has since worked with the House Ethics Committee to take all necessary steps,” said Natalie Young, communications director for Sarbanes. “He voted for the STOCK Act and supports efforts to establish additional measures addressing transparency and stock ownership.”

Rep. Adrian Smith (R-NE)

Rep. Adrian Smith (R-NE) violated the STOCK Act when he was late disclosing three of his spouse's stock purchases. Chip Somodevilla/Getty Images

Rep. Adrian Smith (R-NE) violated the STOCK Act when he was late disclosing three of his spouse's stock purchases. Chip Somodevilla/Getty Images

Smith was more than a year late disclosing some of his wife’s purchases of stock in CarterBaldwin, an executive search firm, valued between $3,003 and $45,000, according to a new May 23 financial disclosure.

“Representative Smith became aware of a potential oversight while filing his financial disclosures on May 15,” said Tiffany Haverly, a spokesperson for Smith. “The transactions not reported were spouse transactions related to her employment, which is not a publicly traded company. He does not own any publicly traded stocks and immediately contacted the House Ethics Committee to notify them of the potential oversight and seek additional guidance.”

Rep. Shri Thanedar (D-MI)

Rep. Shri Thanedar (D-MI) joined a rally with House Democrats in October. Chip Somodevilla/Getty Images

Rep. Shri Thanedar (D-MI) joined a rally with House Democrats in October. Chip Somodevilla/Getty Images

Thanedar, a freshman congressman, filed his annual report on Sept. 27, more than two months after receiving a 60-day extension, to July 14, back in May.

Thanedar reported dozens of mutual funds, exchange-traded funds and stocks, including up to $500,000 in Alphabet, up to $100,000 each in Amazon and American Express and up to $1 million in Apple.

Raw Story reported in February that Thanedar sold off Tesla stock valued up to $130,000 after previously being complimentary of Tesla CEO Elon Musk.

Thanedar’s congressional office did not respond to Raw Story’s request for comment.

Sen. Thom Tillis (R-NC)

Sen. Thom Tillis (R-NC) says a website processing error is to blame for a nine-month-late financial disclosure. Anna Moneymaker/Getty Images

Sen. Thom Tillis (R-NC) says a website processing error is to blame for a nine-month-late financial disclosure. Anna Moneymaker/Getty Images

Tillis on July 15 disclosed an August 2022 sale of multinational IT services provider Kyndryl Holdings stock valued between $1,001 and $15,000.

Tillis’ congressional office says a “processing” error caused the late submission.

“Senator Tillis disclosed the sale to Senate Ethics within the 45-day window but didn’t realize the submission was never processed through the website,” said Adam Webb, a Tillis spokesperson, in an email. “Senate Ethics was able to see the work he did on his periodic transaction disclosure from that time (which was completed). They also noted this has happened to other members before and they plan to make future improvements to the website to add better submission prompts and notifications.”

Rep. Dina Titus (D-NV)

Rep. Dina Titus (D-NV) spoke at an SEIU union worker election day event last November. Mario Tama/Getty Images

Rep. Dina Titus (D-NV) spoke at an SEIU union worker election day event last November. Mario Tama/Getty Images

Titus filed her handwritten report on Aug. 31 after missing her extended Aug. 13 deadline.

Despite being more than two weeks late filing, Titus’ congressional office denied noncompliance.

“Congresswoman Titus completed her annual financial disclosure report in compliance with all legal and ethical laws and regulations,” Michael McShane, Titus’ communications director, via email. “The Congresswoman also does not trade individual stocks.”

In addition to retirement investments, Titus’s report showed various "common stock" investments through a joint trust, including stock in Amazon, Procter & Gamble, GlaxoSmithKline, Microsoft and Verizon.

Rep. David Trone (D-MD)

Democratic congressman commits massive stock law violation

Rep. David Trone (D-MD) speaking at a U.S. Senate candidate forum in Baltimore on April 22, 2024.

Democratic congressman commits massive stock law violation

Rep. David Trone (D-MD) speaking at a U.S. Senate candidate forum in Baltimore on April 22, 2024.

Trone violated federal law by tardily disclosing tens of millions of dollars in government securities and stock trades — nearly a year late in some cases, according to a May 6 congressional financial filling.

Trone reported 28 transactions involving short-term U.S. Treasury bills and a stock sale, valued between $21.65 million and $97.35 million total.

“Congressman Trone is and always has been in good standing with the House Ethics Committee,” Sasha Galbreath, a spokesperson for Trone, told Raw Story via email without further elaborating.

Galbreath later clarified via email, "Congressman Trone disclosed all information relating to these transactions that the rules require, and the Committee staff received notice and a copy of the [periodic transaction report] filing, as well as his full financial disclosure statement, in advance of their filing.”

Rep. Debbie Wasserman Schultz (D-FL)

Rep. Debbie Wasserman Schultz appears to have violated the STOCK Act again with a seven-month-late disclosure. Chip Somodevilla/Getty Images

Rep. Debbie Wasserman Schultz appears to have violated the STOCK Act again with a seven-month-late disclosure. Chip Somodevilla/Getty Images

Wasserman Schultz, the former chairwoman of the Democratic National Committee, was seven months late disclosing a family stock sale, according to a July 11 disclosure, which detailed an October 2022 sale of Adams Resources and Energy Inc. stock on behalf of a dependent child and valued between $1,001 and $15,000.

Wasserman Schultz violated the STOCK Act again on July 1 when she reported five months late a dependent child’s sale of stock in First Trust MLP and Energy Income Fund.

The sale from Dec. 18 was valued between $1,001 and $15,000.

Wasserman Schultz has violated a federal financial disclosure and transparency law multiple times.

Wasserman Schultz first appeared to violate the STOCK Act in 2021 when she was seven months late disclosing up to $60,000 of her and her dependent child’s stock purchases in telecommunications provider Westell Technologies, Insider reported.

Wasserman Schultz’s congressional office did not respond to Raw Story’s requests for comment.

Rep. Maxine Waters (D-CA)

Rep. Maxine Waters (D-CA) speaks during a news conference with the Democratic members of the House Financial Services Committee and the Sustainable Investment Caucus in July. Drew Angerer/Getty Images

Rep. Maxine Waters (D-CA) speaks during a news conference with the Democratic members of the House Financial Services Committee and the Sustainable Investment Caucus in July. Drew Angerer/Getty Images

Waters filed her annual financial disclosure report on Aug. 31. In May, she received a 90-day filing extension with a deadline of Aug. 13.

When she did file, Waters reported spouse and joint trust rental properties valued at up to $5.8 million. Her spouse’s partnership income in the American Golf Joint Venture is valued at up to $250,000.

They also reported up to $1.75 million in mortgages.

Waters’ congressional office did not respond to Raw Story’s request for comment.

Rep. Daniel Webster (R-FL)

Webster was more than a year late disclosing the purchase of a U.S. Treasury I bond valued up to $15,000.

Sen. Sheldon Whitehouse (D-RI)

Sen. Sheldon Whitehouse in Providence, Rhode Island on Nov. 6, 2018, when he won re-election. (Photo by Anthony Ricci/Shutterstock)

Sen. Sheldon Whitehouse in Providence, Rhode Island on Nov. 6, 2018, when he won re-election. (Photo by Anthony Ricci/Shutterstock)

Whitehouse was four days late reporting four stock sales from himself and his spouse, including two sales of stock in multinational pharmaceutical company Johnson & Johnson, valued between $15,001 and $50,000 each. He also reported the sale of stock in food manufacturer Conagra Brands and fast food giant McDonalds, each valued between $1,001 and $15,000.

“We regret that the filing was delayed by a few days as a result of a communications gap between consultants,” Meaghan McCabe, communications director for Whitehouse, told Raw Story. “The senator and his wife do not trade stocks, and their account manager acts independently without any input from the senator or his family.”

Rep. Roger Williams (R-TX)

Rep. Roger Williams (R-TX) failed to properly report 16 stock trades and one bond transaction from two of his wife’s brokerage accounts, some going back as far as February 2019.

Each stock trade was in the $1,001 to $15,000 range involving a variety of companies such as tech conglomerate Alphabet, artificial intelligence company NVIDIA, pharmaceutical giant Eli Lilly and Company and media and entertainment conglomerate Walt Disney and Company.

Nonpartisan ethics group, the Campaign Legal Center, previously filed a complaint against Williams and six other members of Congress for failing to properly disclose their stock transactions in 2021, NPR reported. Williams’ 2021 violations involved three undisclosed 2019 stock trades for wife, Patty Williams, totaling up to $45,000.

Williams’ congressional office did not respond to Raw Story’s request for comment.

Rep. Rob Wittman (R-VA)

Rep. Rob Wittman violated the STOCK Act in August and September with late disclosures. Pete Marovich/Getty Images

Rep. Rob Wittman violated the STOCK Act in August and September with late disclosures. Pete Marovich/Getty Images

Wittman’s Sept. 30 disclosure reported 10 stock transactions, nine of which were past the STOCK Act's 45-day deadline. The late transactions totaled up to $135,000 and were investments in various companies including semiconductor manufacturer Broadcom, capital markets company S&P Global and transportation company Union Pacific, to name a few.

The transactions were reported between two weeks and nearly four months late.

In recent weeks, Wittman also reported four late transactions totaling between $4,004 and $60,000 on an Aug. 13 federal financial disclosure, Raw Story reported.

Wittman’s oldest stock transaction on the report was made on Feb. 27, 2022, with the sale of Piedmont Office Realty Trust stock. Between July 2022 and December 2022, Wittman purchased stock in Accenture, Mastercard and TJX Companies. All transactions were in the $1,001 to $15,000 range.

His congressional office did not respond to Raw Story’s request for comment for either story.

Congressional candidate violations

Tom Barrett, a Republican congressional candidate in one of the nation's most competitive 2024 Michigan House races, publicly disclosed his personal finances, as required by federal law — but only after a Raw Story investigation revealed he had failed to do so.

Barrett filed his candidate financial disclosure report on Nov. 2, a day after Raw Story reported he was nearly three months late in filing his disclosure.

Per the House Ethics guidelines and the Ethics in Government Act, Barrett needed to file his financial disclosure 30 days after July 10 after meeting candidacy and fundraising requirements meaning his disclosure was due Aug. 9.

Barrett isn’t the first high-profile congressional candidate to fail to file his financial disclosure report on time.

J.R. Majewski — a 2022 Republican congressional candidate in an highly competitive Ohio district and QAnon conspiracy theory promoter — disclosed two-and-a-half years worth of his personal financial activity only after Insider reported he was violating the same federal law as Barrett.

The same happened last year with Trump-backed congressional candidate Joe Kent, a Republican running for Congress in Washington state, who filed his financial disclosures months late after the violation was revealed by Insider.

Potential conflicts of interest

The STOCK Act prohibits "the use of nonpublic information for private profit."

The law says, "The Select Committee on Ethics of the Senate and the Committee on Ethics of the House of Representatives shall issue interpretive guidance of the relevant rules of each chamber, including rules on conflicts of interest and gifts, clarifying that a Member of Congress and an employee of Congress may not use nonpublic information derived from such person's position as a Member of Congress or employee of Congress or gained from the performance of such person's official responsibilities as a means for making a private profit."

Raw Story has identified a handful of members of congressional armed services committees who have personally invested in the stock of major U.S. defense contractors. Among them:

Rep. Marjorie Taylor Greene (R-GA)

Rep. Marjorie Taylor Greene (R-GA) speaks to members of the press at the U.S. Capitol on May 8, after her peers voted overwhelmingly to table her motion to vacate Speaker Mike Johnson (R-GA). (Photo by Kent Nishimura/Getty Images)

Rep. Marjorie Taylor Greene (R-GA) speaks to members of the press at the U.S. Capitol on May 8, after her peers voted overwhelmingly to table her motion to vacate Speaker Mike Johnson (R-GA). (Photo by Kent Nishimura/Getty Images)

Greene reported on May 2 that she purchased up to $15,000 of stock in Qualcomm, a federal defense contractor while serving on the Homeland Security Committee and the Subcommittee on Border Security and Enforcement.

She also invested up to $15,000 in technology giant Microsoft while serving on on the Government Oversight and Accountability Committee and the Subcommittee on Cybersecurity, Information Technology and Government Innovation, along with purchasing in June up to $15,000 in cybersecurity technology company, CrowdStrike Holdings.

The Department of Defense granted CrowdStrike authorization to the highest level of controlled unclassified information in May 2023. CrowdStrike works with the Department of Defense, Defense Industrial Base companies and the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency, according to a May 31, 2023 company press release.

Greene's congressional office did not respond to Raw Story's requests for comment.

Sen. Markwayne Mullin (R-OK)

Then-Rep. Markwayne Mullin (R-OK) greets Facebook co-founder Mark Zuckerberg before he testifies in front of the House Energy and Commerce Committee in 2018. Chip Somodevilla/Getty Images

Then-Rep. Markwayne Mullin (R-OK) greets Facebook co-founder Mark Zuckerberg before he testifies in front of the House Energy and Commerce Committee in 2018. Chip Somodevilla/Getty Images

Mullin purchased between $15,001 and $50,000 in stock in Raytheon on Sept. 13, according to October congressional personal financial disclosure filings reviewed by Raw Story. Raytheon was awarded more than $1.7 billion in contracts in September, according to a Raw Story analysis of contract announcements from the Department of Defense.

“Sen. Mullin follows the law as well as Senate Ethics rules,” said a spokeswoman for Mullin, who declined to be named.

Rep. Bill Keating (D-MA)

Rep. William Keating (D-MA) delivers his opening statement during a U.S. House Foreign Affairs Subcommittee during a hearing on Capitol Hill on September 21, 2022, in Washington, DC. Samuel Corum/Getty Images

Rep. William Keating (D-MA) delivers his opening statement during a U.S. House Foreign Affairs Subcommittee during a hearing on Capitol Hill on September 21, 2022, in Washington, DC. Samuel Corum/Getty Images

Keating, another congressional armed services committee member, disclosed purchasing between $15,001 and $50,000 worth of Boeing Co. corporate notes, according to a U.S. House financial document filed Sept. 28 and reviewed by Raw Story.

Then, on Feb. 8, Keating sold a Boeing corporate note valued at between $15,001 and $50,000, and on Feb. 28, sold Boeing stock shares valued at between $1,001 and $15,000, according to a federal disclosure. The trades came at a time when Boeing, a defense contractor, faces federal scrutiny over its aircraft safety protocols and manufacturing quality.