Why 'Kamala' and 'Harris' could become hot new baby names

Don't be shocked if you encounter a baby "Kamala" or little "Harris" next year.

Or two.

Or 200.

For Kamala Harris — who could become the first female president who's also Black and South Asian if she beats Donald Trump in November — the historical significance of her election is likely to manifest itself in maternity wards across the nation.

That's because spikes in baby name popularity among frequently correlate with the arrival of a new president and first lady, according to a Raw Story analysis of Social Security Administration birth name data going back 75 years.

With Harris having accepted the Democratic presidential nomination, here's what Raw Story found about the effect various White House occupants and their immediate family members have on American baby name trends:

Barack Obama

Through 2007, the name "Obama" as a first name did not appear in the Social Security Administration's baby name data at all. (The Social Security Administration does not provide data on baby names with fewer than five occurrences to "safeguard privacy.")

But in 2008, the year Democrat Barack Obama won the White House, 14 baby boys received the first name "Obama."

In 2009, 16 baby boys did, Social Security Administration data indicates.

Similarly, there were only five baby boys named "Barack" during 2007. By 2008, there were 52 baby boys named "Barack." In 2009: 71, putting it exactly on par with other somewhat uncommon, but not too uncommon boy names that year, including Caine, Demitri, Jadin, Pavel and Tracy.

The "Barack" mini-spike didn't last long, however, and by last year, only eight American-born baby Baracks came into the world.

Hillary Clinton

"Hillary" as a baby name has had a most turbulent history — not unlike one of the most notable Hillarys on Earth, Hillary Clinton.

A relatively uncommon name until the 1970s, "Hillary" the baby name peaked in wattage during 1992 — the same year Bill Clinton won the White House and Hillary Clinton became first lady-in-waiting — as the nation's 132nd most popular baby name that year with more than 2,500 little Hillarys.

But Americans soured on "Hillary" soon thereafter. By 1998, it had fallen out of the Top 800 in baby name popularity. By 2007, it sat in 961st place.

Then a funny thing happened: In 2008 — the same year Hillary Clinton first ran for president and delivered her notable "glass ceiling" concession speech — "Hillary" jumped 239 spots to 722nd place.

Never again after 2008 did "Hillary" find its way into the Top 1,000 baby names again, with year-over-year declines that have pushed it to the edge of baby name extinction. Just 71 baby Hillarys were born in 2023.

The only year since 2008 when the Hillary decline reversed? You guessed it: 2016, when Clinton again ran for the presidency, only to lose to Trump. That year, there were 172 baby Hillarys, up from 138 in 2015.

By 2017, there would only be 63, according to Social Security Administration data.

Donald Trump

From 1920 to 1960, the name "Donald" was a perennial Top 20 boys name. It remained in the Top 100 each year until 1990.

But its popularity rank declined or stayed the same every year after that — until 2017, the year Donald Trump became president of the United States.

It's wasn't much — "Donald" as a baby name ticked up from 489th place in 2016 to 486th place in 2017 — and the name continued to slip in popularity through 2020, when it languished in 609th place as Trump lost his reelection bid.

However, in 2021 — the year Trump supporters stormed the U.S. Capitol in his name and the U.S. Senate acquitted Trump in his second impeachment trial — "Donald" jumped back up to the 596th most popular name.

After declining again in 2022 (679th place), it staged another mild comeback and ended 2023 — the year Trump's latest presidential campaign hit stride — in 657th place.

Melania Trump

The first lady from 2017 to 2021, Melania Trump arguably affected baby name trends more than her husband.

Consider that in 2014, only 78 baby girls received the name "Melania."

Melania Trump holds baby Barron Trump in 2007. (Photo by Jean Baptiste Lacroix/WireImage)

Melania Trump holds baby Barron Trump in 2007. (Photo by Jean Baptiste Lacroix/WireImage)

But in 2015, the year Trump announced his first presidential bid, that number increased to 92. This kicked off a several-year run of modest popularity for "Melania" that peaked the year Trump took office: 2016 (131 Melanias), 2017 (283), 2018 (233), 2019 (210), 2020 (182) and 2021 (154).

Since Trump left the White House in 2021, the popularity of "Melania" has continued to wane, with only 113 baby Melanias in 2023 — the fewest since 2015.

Ivanka Trump

Donald Trump's elder daughter has a similar baby name story — there were only 42 newborn Ivankas in 2014 and 37 in 2015.

But by 2016, there were 113. In 2017, when Donald Trump became president and Ivanka Trump became one of his White House advisers, there were 165 baby Ivankas.

Since then, "Ivanka" as a baby name has only again cracked triple digits once — in 2020 — and has faded to 52 instances by 2023, according to Social Security Administration data.

Joe Biden

"Joseph" has been one of the most common names in the United States for much of the nation's history, never once outside the Top 30 in any year dating to the 19th century. Therefore, a president with that name isn't likely to move the baby name popularity needle too much.

In fact, Social Security Administration data indicates that the baby name "Joseph" hit a modern popularity low — relatively speaking — during Joe Biden's first three years in office, where it finished in 28th place in 2021, 30th place in 2022 and 29th place in 2023.

"Joe" as a given baby name also declined to its lowest recorded modern level, as well — 908th place in 2023, after ranking within the Top 100 as recently as 1970, just before Biden became a U.S. senator from Delaware.

One consolation prize for the current president: Social Security Administration data had never publicly recorded "Biden" being used as a given name — until 2021, when 11 baby boys received the name "Biden" in the year Joe Biden became president.

The baby name party wouldn't last, though, as no little boys named "Biden" appear in the data for 2022 or 2023.

Other notable trends

- The popularity of the baby name "Dwight" had twin peaks — one in 1945 (126th place) as Gen. Dwight D. Eisenhower heralded victory in World War II, and another in 1952 and 1953 (123rd place and 122nd place, respectively) during the early years of Eisenhower's presidential administration. In no other years has the name been so popular.

- The baby name "Jacqueline" never entered the Top 50 most popular until 1961, the year John F. Kennedy became president and Jacqueline Kennedy became first lady. That year, the name's popularity peaked in 37th place, a spot it tied in 1964, the year after John F. Kennedy was assassinated. By 2004, it exited the Top 100, and in 2023, it had dropped to a 110-year low of 539th place.

- "Michelle" as a baby name has been on a slow, five-decade-long march downward after peaking in 1972 in 2nd place. Two years of popularity stability came in 2008 (101st place) and 2009 (104th place), when Michelle Obama sprung onto the national scene. Since then, "Michelle" has slid unabated to a 80-year low in 2023 of 401th place, ranking it alongside the likes of girl baby names "Xiomara," "Helen," "Maryam" and "Frances."

What about Harris?

Few American babies have ever been named "Kamala" — from a Sanskrit word meaning "lotus."

But there were 25 U.S. babies named "Kamala" in 2021, the year Harris took office as vice president. That's the most American baby Kamalas since the late 1970s, according to Social Security Administration data.

Lots of people, including Donald Trump, continue to pronounce Harris' first name incorrectly — it's pronounced "COMMA-la," not "kuh-MA-LA" or "kah-MAL-uh. Democrats turned this into a Trump-tweaking comedy bit at the Democratic National Convention, with Harris' two young grandnieces joining actress Kerry Washington for a pronunciation session with audience participation.

"Harris" as a first name for boys enjoyed some measure of popularity during the first half of the 20th century. It then fell out of favor and crashed out of the Top 1,000 most popular boy baby names for the first time last century in 1969.

After some fits and starts in and out of the Top 1,000 during the 1970s and 1980s, "Harris" was gone for good after that, save for two years — 2016, when voters elected Kamala Harris to the U.S. Senate, and 2020, when voters elected her vice president.

Taylor A. Humphrey, a professional baby name consultant who runs What's in a Baby Name — yes, such services exist — is skeptical that "Kamala" will see a massive spike in popularity if Kamala Harris wins the presidency, despite the historic nature of such a victory.

She likened "Kamala" to other mononyms such as "Oprah," "Beyoncé" and "Madonna," none of which have ever rivaled the popularity of, say, the Jessica/Ashley/Jennifer set of the 1980s, or the Emma/Olivia/Sophia lot of the 2010s.

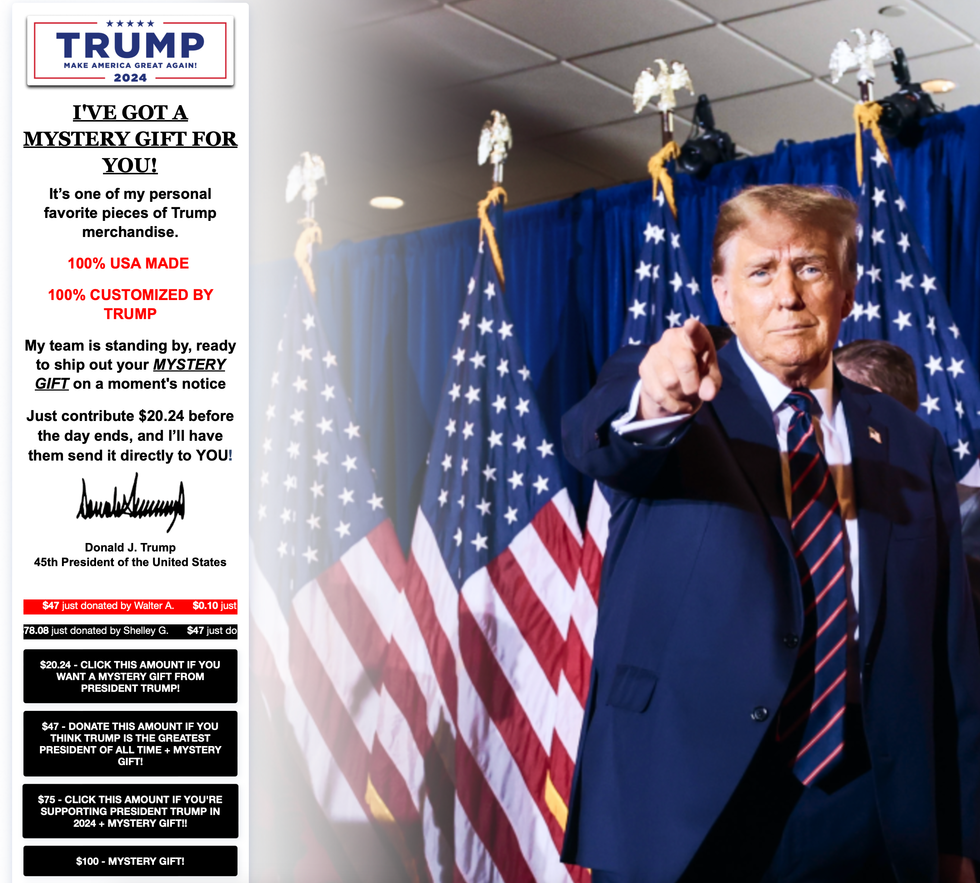

ALSO READ: 21 worthless knick-knacks Donald Trump will give you for your cash

Humphrey noted that immediately before the Oprah Winfrey Show began, fewer than five girls were given the name in the United States. A year after the show first aired, in 1987, 37 girls were given the name Oprah — exponentially more, but still just a tiny fraction of the roughly 1.8 million girls born that year.

"These names are iconic, and thus, often feel too evocative of one person's singular greatness," Humphrey said. "It can be difficult for parents to see how their own children will grow into these names when they're so powerfully aligned with one person.

Humphrey is more bullish on "Harris," noting that there's a long-term trend toward parents using the surnames of presidents as first names.

She points to girl names such as "Taylor," "Madison," "Reagan," "Kennedy" and "Monroe," and boys names such as "Lincoln," "Jackson," "Ford," "Grant," "Carter," "Harrison" and "Tyler."

Even "Nixon" began a run in the Top 1,000 starting in 2011, and it hasn't left yet.

"Presidential surnames exude elegance, gravitas, and prestige," Humphrey said.

One name for which she's rooting to enter the Top 1,000 some day: "Robinette" Biden's "unique, nature-inspired" middle name, which is also his paternal grandmother's maiden name.

In 2023, Robinette did not register a blip in Social Security Administration data, meaning that "Kamala" or "Harris" may still have a better shot at baby name ascendance — at least for now.

This article was originally published on Aug. 14, 2024, and updated to include new developments.

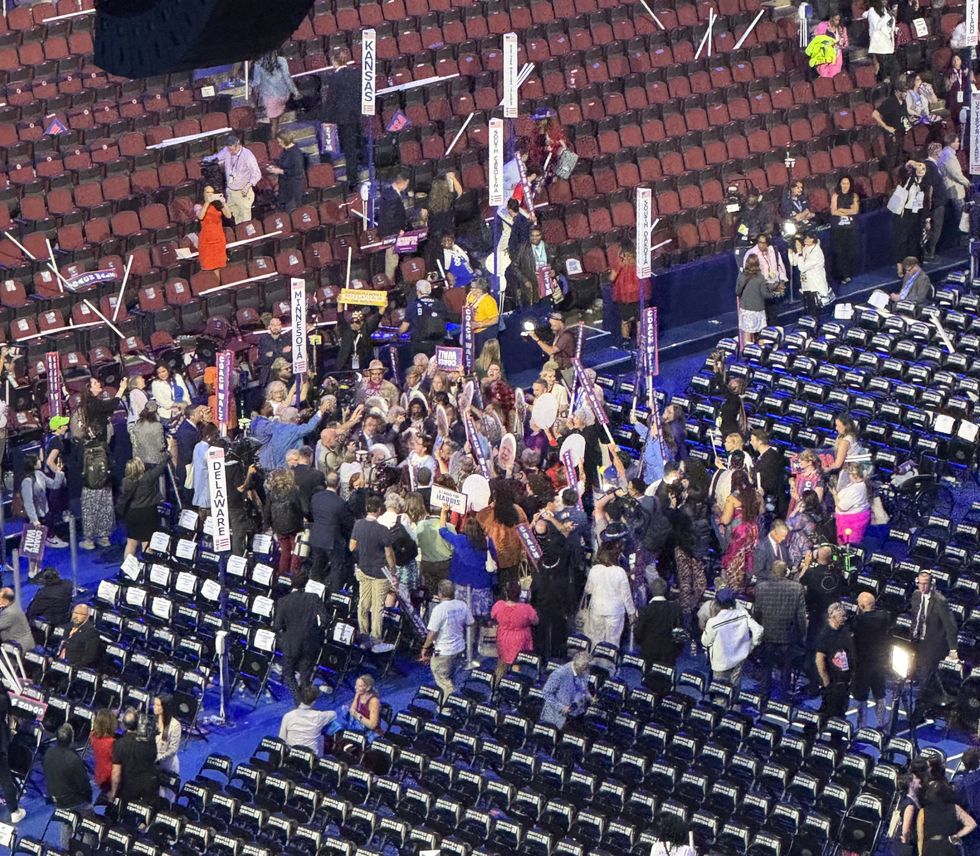

Members of the Minnesota delegation to the Democratic National Convention stayed long after the Thursday session had ended in Chicago's United Center — in a bid to party with their state's governor,

Members of the Minnesota delegation to the Democratic National Convention stayed long after the Thursday session had ended in Chicago's United Center — in a bid to party with their state's governor,  Screen grab of "Save America" book for sale on Winning Team Publishing's website.

Screen grab of "Save America" book for sale on Winning Team Publishing's website. A long line of delegates and others who abandoned protest-delayed buses make their way to the United Center in Chicago, where the Democratic National Convention begins today, Aug. 19, 2024. (Alexandria Jacobson / Raw Story)

A long line of delegates and others who abandoned protest-delayed buses make their way to the United Center in Chicago, where the Democratic National Convention begins today, Aug. 19, 2024. (Alexandria Jacobson / Raw Story)  A technician adjusts a solar-powered security camera tower outside McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal /

A technician adjusts a solar-powered security camera tower outside McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal /  A fleet of tow trucks stand at the ready outside security barriers at Chicago’s United Center for the Democratic National Convention. (Matt Laslo / Raw Story)

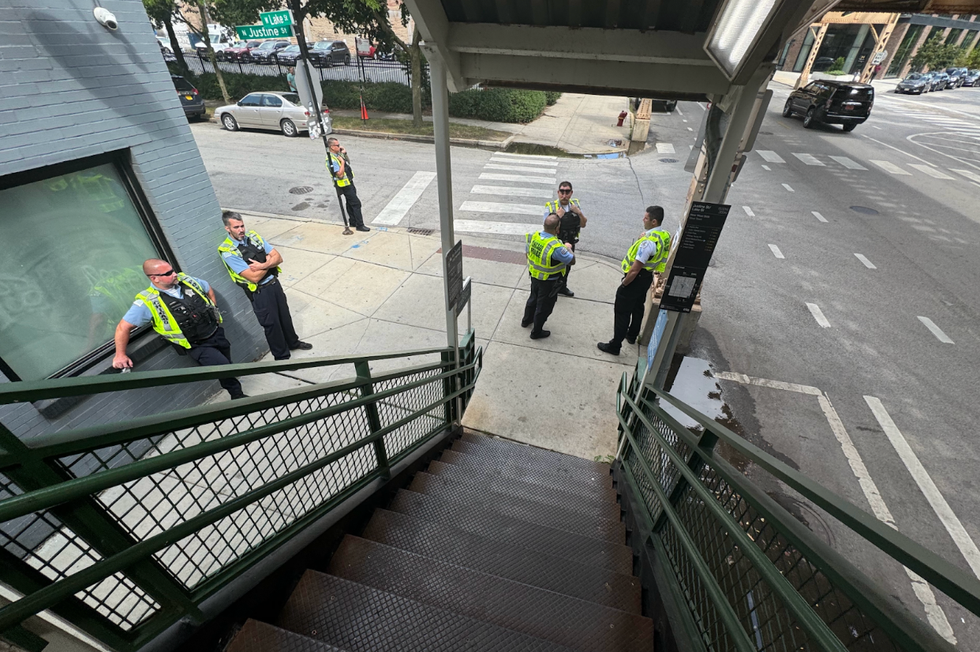

A fleet of tow trucks stand at the ready outside security barriers at Chicago’s United Center for the Democratic National Convention. (Matt Laslo / Raw Story) A half-dozen Chicago Police officers stand watch outside the Ashland "L" Train station on Aug. 18, 2024, near the United Center, where the Democratic National Committee's evening events are being conducted. (Dave Levinthal / Raw Story)

A half-dozen Chicago Police officers stand watch outside the Ashland "L" Train station on Aug. 18, 2024, near the United Center, where the Democratic National Committee's evening events are being conducted. (Dave Levinthal / Raw Story) Snowplows are being deployed as extra layers of security across Chicago for the Democratic National Convention. (Matt Laslo / Raw Story)

Snowplows are being deployed as extra layers of security across Chicago for the Democratic National Convention. (Matt Laslo / Raw Story) Chicago Police officers fill up their motorcycles during their patrol Sunday afternoon. (Matt Laslo / Raw Story)

Chicago Police officers fill up their motorcycles during their patrol Sunday afternoon. (Matt Laslo / Raw Story) A Cook County, Ill., bomb squad truck is parked outside McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal / Raw Story)

A Cook County, Ill., bomb squad truck is parked outside McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal / Raw Story)  A Mutual Aid Box Alarm System decontamination truck from the Illinois Emergency Management Agency drives around the perimeter of McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal / Raw Story)

A Mutual Aid Box Alarm System decontamination truck from the Illinois Emergency Management Agency drives around the perimeter of McCormick Place in Chicago on Aug. 18, 2024. McCormick Place is hosting many of the daytime events associated with the Democratic National Convention. (Dave Levinthal / Raw Story) Federal agents running a security checkpoint near the United Center on the afternoon of Aug. 18, 2024. (Matt Laslo / Raw Story)

Federal agents running a security checkpoint near the United Center on the afternoon of Aug. 18, 2024. (Matt Laslo / Raw Story) United States Capitol Police patrol the streets around the United Center Sunday. (Matt Laslo / Raw Story)

United States Capitol Police patrol the streets around the United Center Sunday. (Matt Laslo / Raw Story) A law enforcement helicopter circles the area around Chicago’s United Center Sunday evening ahead of the Democratic National Convention. (Matt Laslo / Raw Story)

A law enforcement helicopter circles the area around Chicago’s United Center Sunday evening ahead of the Democratic National Convention. (Matt Laslo / Raw Story) Chicago snowplow turned security barrier. (Matt Laslo / Raw Story)

Chicago snowplow turned security barrier. (Matt Laslo / Raw Story) Local and national law enforcement officials and security contractors setting up concrete and steel barriers downtown Chicago at 2 am Sunday morning. (Matt Laslo / Raw Story)

Local and national law enforcement officials and security contractors setting up concrete and steel barriers downtown Chicago at 2 am Sunday morning. (Matt Laslo / Raw Story) Press logistics volunteers for the Democratic National Convention receive pre-convention instructions during a tour of the Chicago Bulls' basketball training facility, which is doubling as a media filing center. The Democratic National Convention takes place from Aug. 19, 2024, through Aug. 22, 2024, at the adjacent United Center in Chicago. (Dave Levinthal /

Press logistics volunteers for the Democratic National Convention receive pre-convention instructions during a tour of the Chicago Bulls' basketball training facility, which is doubling as a media filing center. The Democratic National Convention takes place from Aug. 19, 2024, through Aug. 22, 2024, at the adjacent United Center in Chicago. (Dave Levinthal /  Close-up of Trump sign at Trump International Hotel and Tower in downtown Chicago (Photo by Dave Levinthal/Raw Story)

Close-up of Trump sign at Trump International Hotel and Tower in downtown Chicago (Photo by Dave Levinthal/Raw Story) An ad from the conservative Epoch Times newspaper organization, advertising its website to motorists driving toward downtown Chicago from O’Hare International Airport. (Photo by Dave Levinthal/Raw Story)

An ad from the conservative Epoch Times newspaper organization, advertising its website to motorists driving toward downtown Chicago from O’Hare International Airport. (Photo by Dave Levinthal/Raw Story) One of several billboards from Illinois Democrats that says "Protect Women's Rights." This particular billboard is sponsored by Illinois Gov. JB Pritzker's campaign committee. (Photo by Matt Laslo/Raw Story)

One of several billboards from Illinois Democrats that says "Protect Women's Rights." This particular billboard is sponsored by Illinois Gov. JB Pritzker's campaign committee. (Photo by Matt Laslo/Raw Story) An ad featuring Shermann “Dilla” Thomas, a historian and popular TikTok creator, as part of the "The Future Is Built In Chicago,” campaign. (Alexandria Jacobson/Raw Story)

An ad featuring Shermann “Dilla” Thomas, a historian and popular TikTok creator, as part of the "The Future Is Built In Chicago,” campaign. (Alexandria Jacobson/Raw Story) A billboard on Aug. 16, 2024, en route to downtown Chicago, sponsored by pro-abortion rights organization Women’s Declaration International USA. (Photo by Dave Levinthal/Raw Story)

A billboard on Aug. 16, 2024, en route to downtown Chicago, sponsored by pro-abortion rights organization Women’s Declaration International USA. (Photo by Dave Levinthal/Raw Story) An advertisement for C-SPAN’s coverage of the Democratic National Convention greets travelers at O’Hare International Airport on Aug. 16, 2024, in Chicago. (Photo by Dave Levinthal/Raw Story)

An advertisement for C-SPAN’s coverage of the Democratic National Convention greets travelers at O’Hare International Airport on Aug. 16, 2024, in Chicago. (Photo by Dave Levinthal/Raw Story) Fox News channel ad with the slogan, "America is watching ... are you?" (Photo by Matt Laslo/Raw Story)

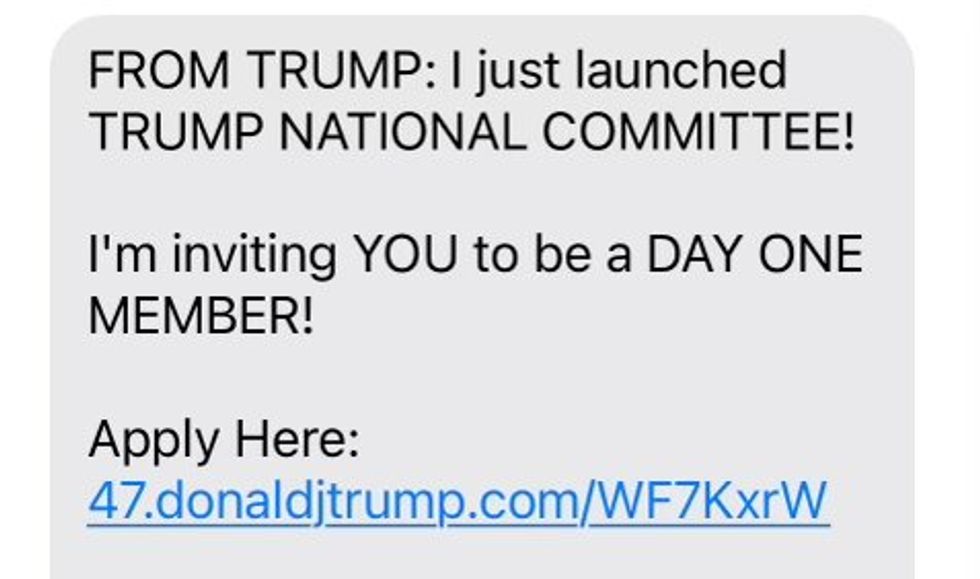

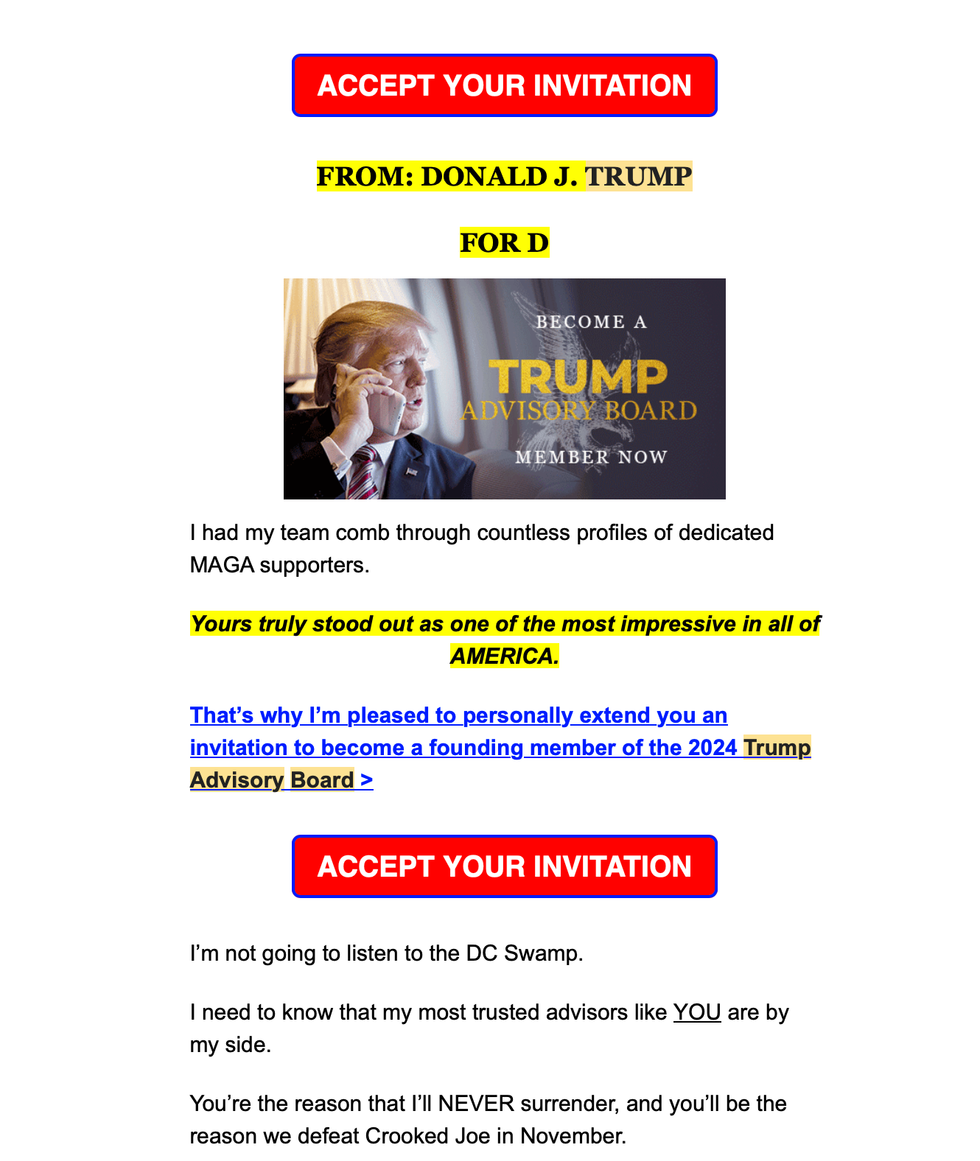

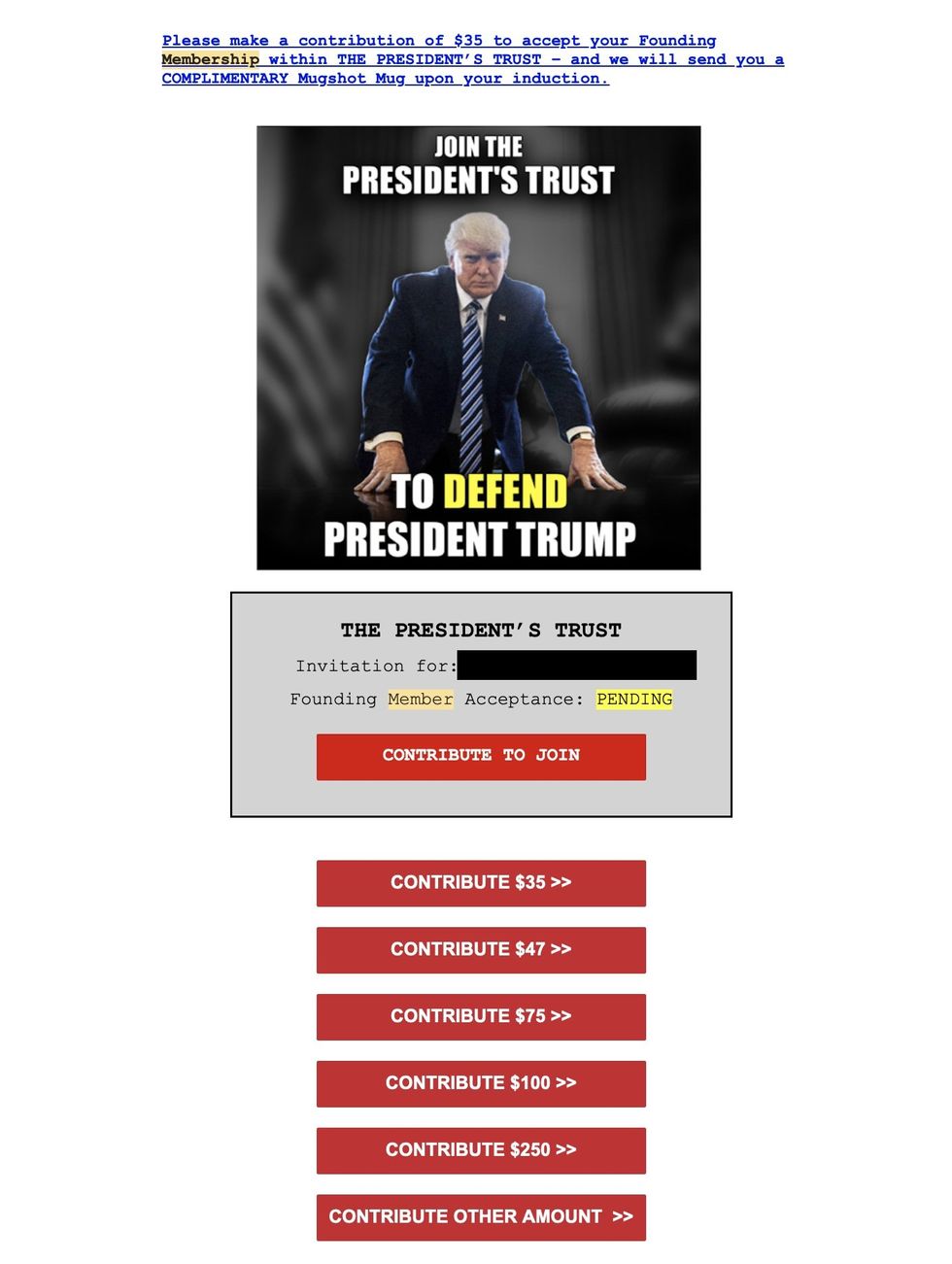

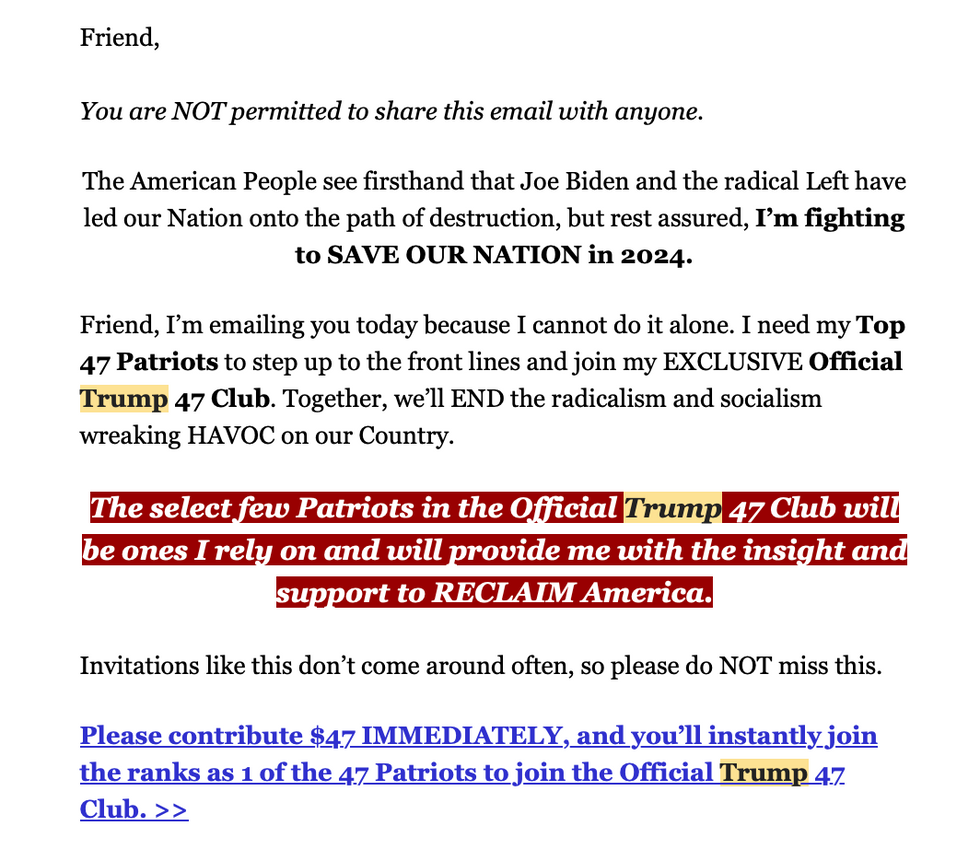

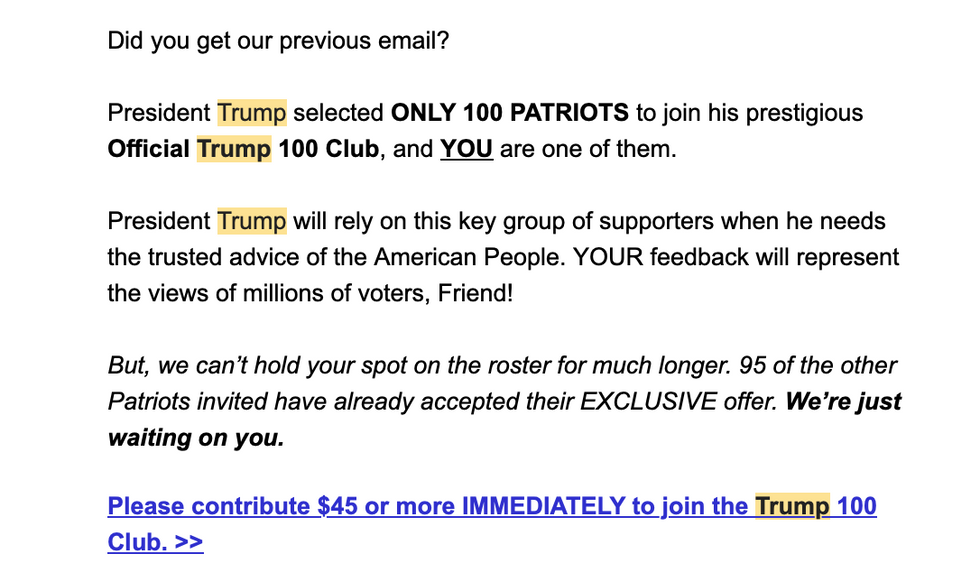

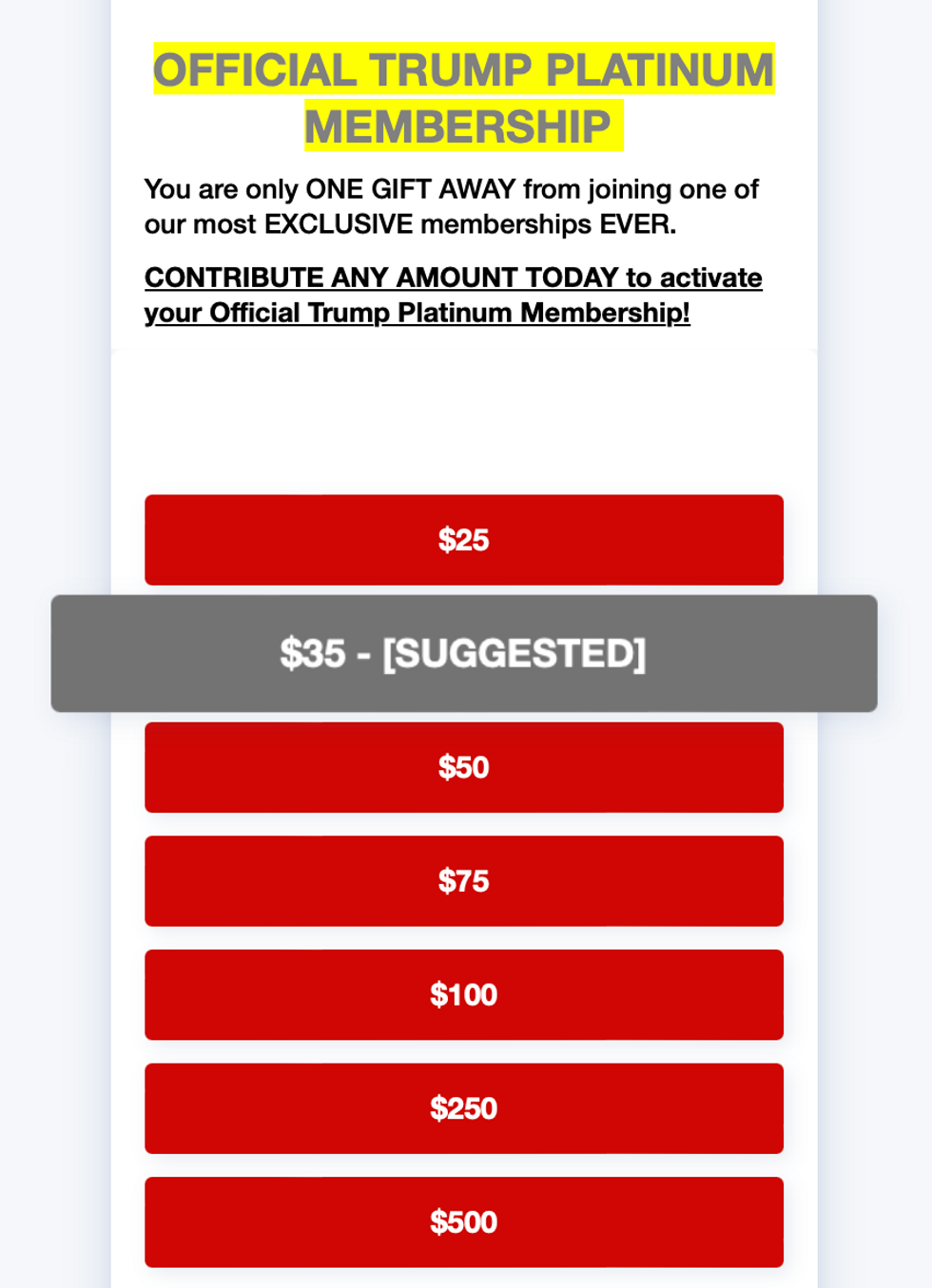

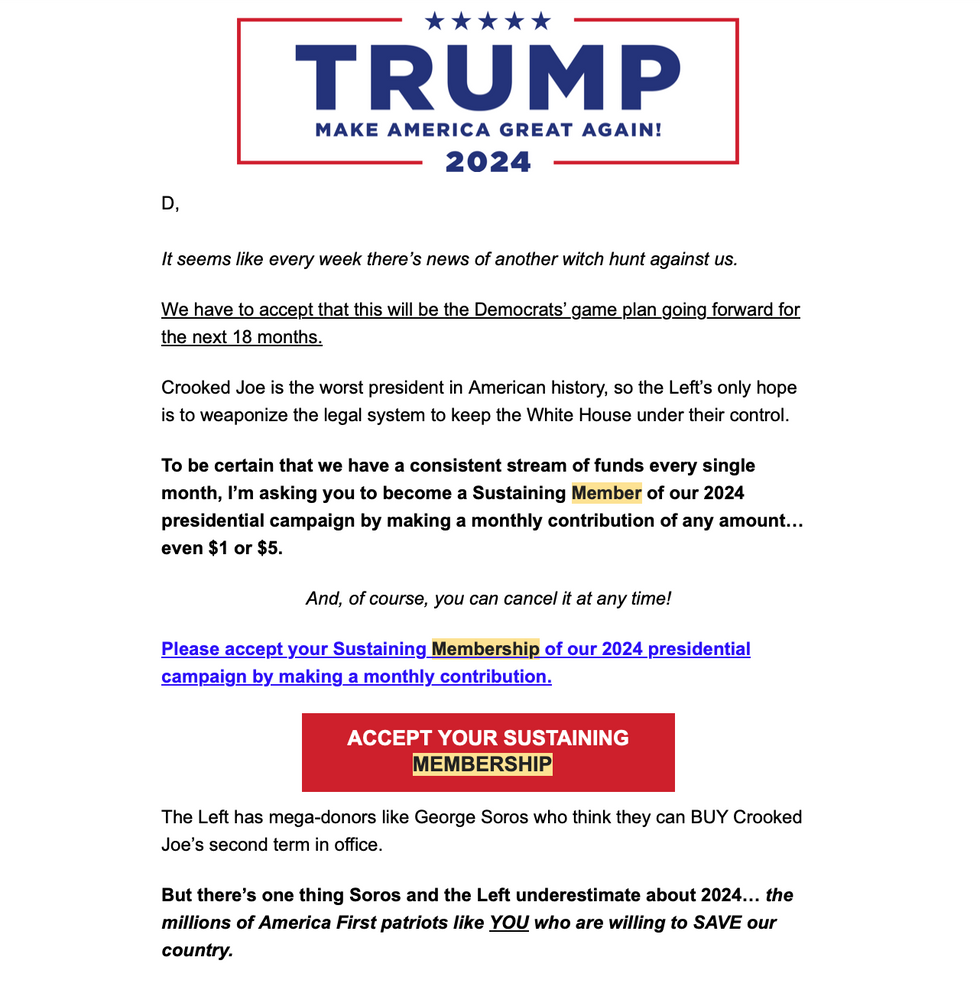

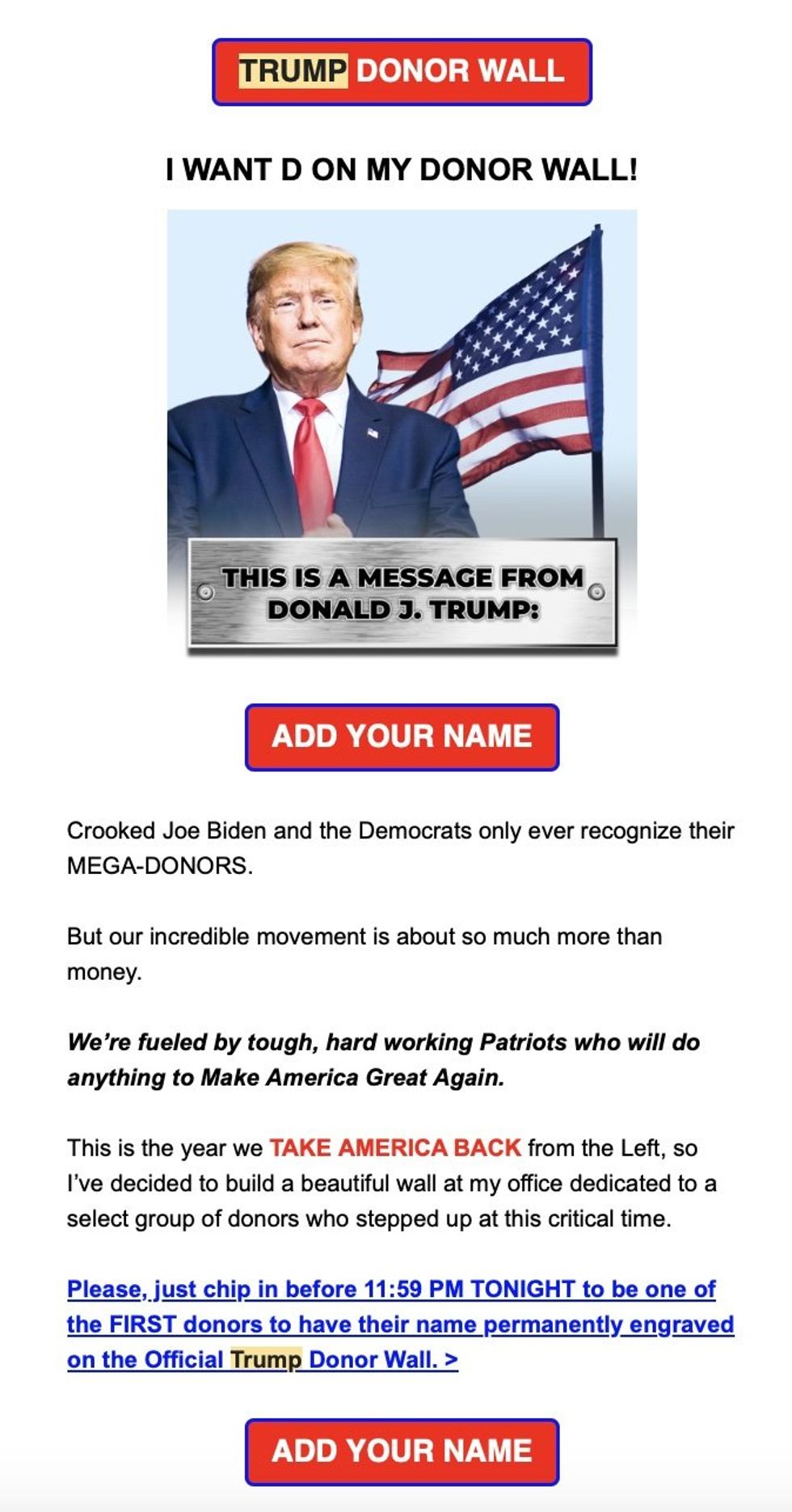

Fox News channel ad with the slogan, "America is watching ... are you?" (Photo by Matt Laslo/Raw Story) Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

Source: Donald Trump campaign Source: Donald Trump campaign

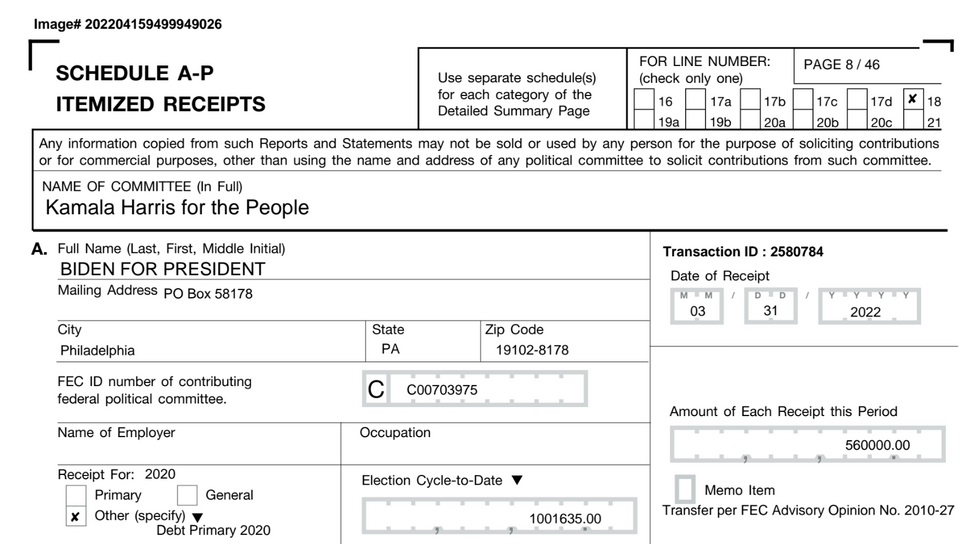

Source: Donald Trump campaign Source: Federal Election Commission

Source: Federal Election Commission