Republican elected officials returned to their districts on the heels of a major legislative win for the monstrous tax cuts they passed. However, most Americans believe the cuts won't benefit them.

Such fears are well founded, according to the New York Times. While Speaker Paul Ryan celebrates his "win," other Republicans are "more reluctant to acknowledge the true impact" of the law they just passed on their districts.

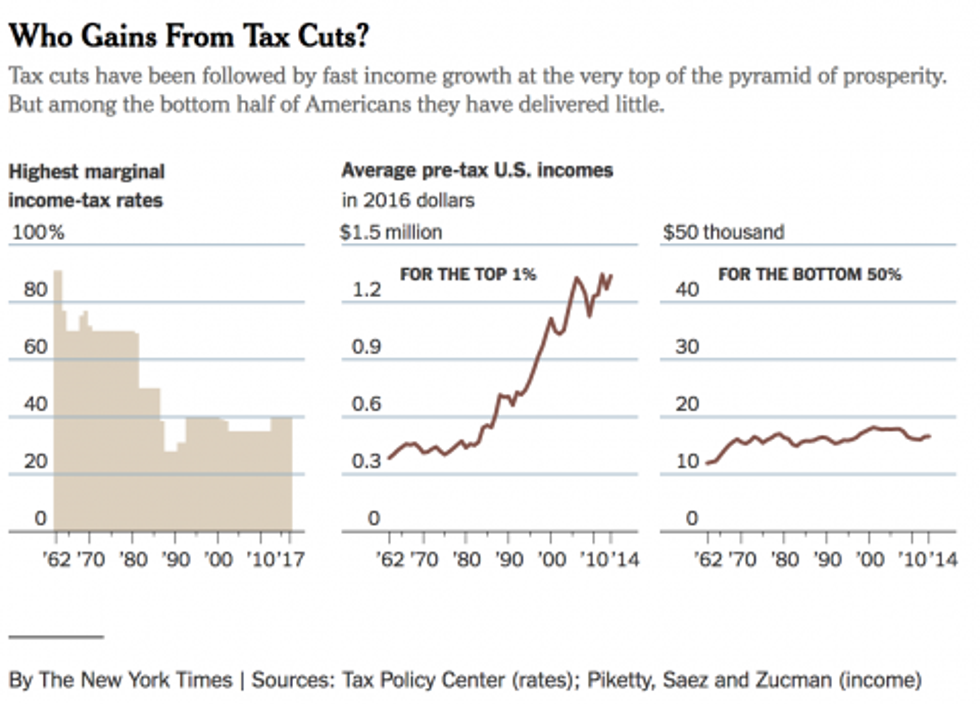

Perhaps it's because President Ronald Reagan's tax cuts didn't exactly work the way the GOP promised. The U.S. GDP increased throughout Reagan's terms, but income actually shrank for the bottom half of wage earners. The average income in 1980, when Reagan was elected, was $16,371. His final year in office, that number actually dropped to $16,268.

Reagan's economic plan was called "trickle-down economics" because the thought was that giving huge tax cuts to businesses and higher wage earners would ultimately filter down to lower wage earners by creating jobs. The same philosophy has been touted by Trump's administration.

No bigger indictment came than from an embarrassing moment, Trump's chief economic adviser Gary Cohn brought together a group of chief executives along with the Wall Street Journal. Cohn's touted the administration's pledge to slash the corporate tax rate to 20 percent. But when a Journal editor asked the crowd if they planned to reinvest their new capital to hire more or pay more to workers, only a few CEOs raised their hands that they would.

"Why aren't the other hands up?" an oblivious Cohn asked.

The cuts are expected to add $1.5 trillion to the deficit, but according to Cohn, it will spur such economic growth that it will zero out the amount it's adding to the deficit. Even Speaker Paul Ryan doesn't believe the hype. Just after the Senate passed the first version of the tax bill, Ryan admitted that in 2018 they will aim to reduce spending on "federal health care and anti-poverty programs," claiming that they needed to reduce the deficit.

Those that did manage to get ahead after the Reagan tax cuts were the very top richest Americans, The Times explained. Those in the top 1 percent of wage earners saw their earnings grow by 6 percent within the first year. By the time Reagan's Vice President, George H.W. Bush, was running for office promising "no new taxes," the economy was in dire straights. He was forced to sign tax increases.

When President Bill Clinton inherited the disaster, he implemented further increases coupled with cuts to government spending. By the time he left office, the United States was in a surplus for the first time in years. It prompted George W. Bush to pass another hefty Reagan-like tax cut in 2001 and 2003. He claimed the country had a budget surplus “because taxes are too high and government is charging more than it needs.”

The same thing that happened to Reagan happened to Bush. Wages came to a screeching halt. "The average income of the bottom half of Americans slid from $17,827 to $17,473, accounting for inflation," The Times reported. "After factoring in taxes and transfers, that sum did increase — 3.5 percent, or about 0.4 percent a year.

"The grand Republican promise of faster growth has proved to be, if not necessarily false, at least irrelevant for the very segment of the electorate for which it was directed," The Times explained.

Yet, the GOP still swears it'll work. When it doesn't, they won't admit they're wrong, they'll simply call for greater cuts to government programs desperately needed by the poor, veterans and the elderly. Political strategists expect Republicans to continue running on a "family values" platform.