Sen. Ron Wyden (D-OR) laid bare the plans of how House Republicans plan to finance their tax cuts for the rich by gutting support for everyone else, in a thread posted to Bluesky on Friday afternoon.

"My staff just got ahold of this memo from House Budget Committee Republicans," wrote Wyden. "It's lengthy and hard to digest but it tells us exactly how Republicans plan to sell out the American people for another round of tax cuts to the rich."

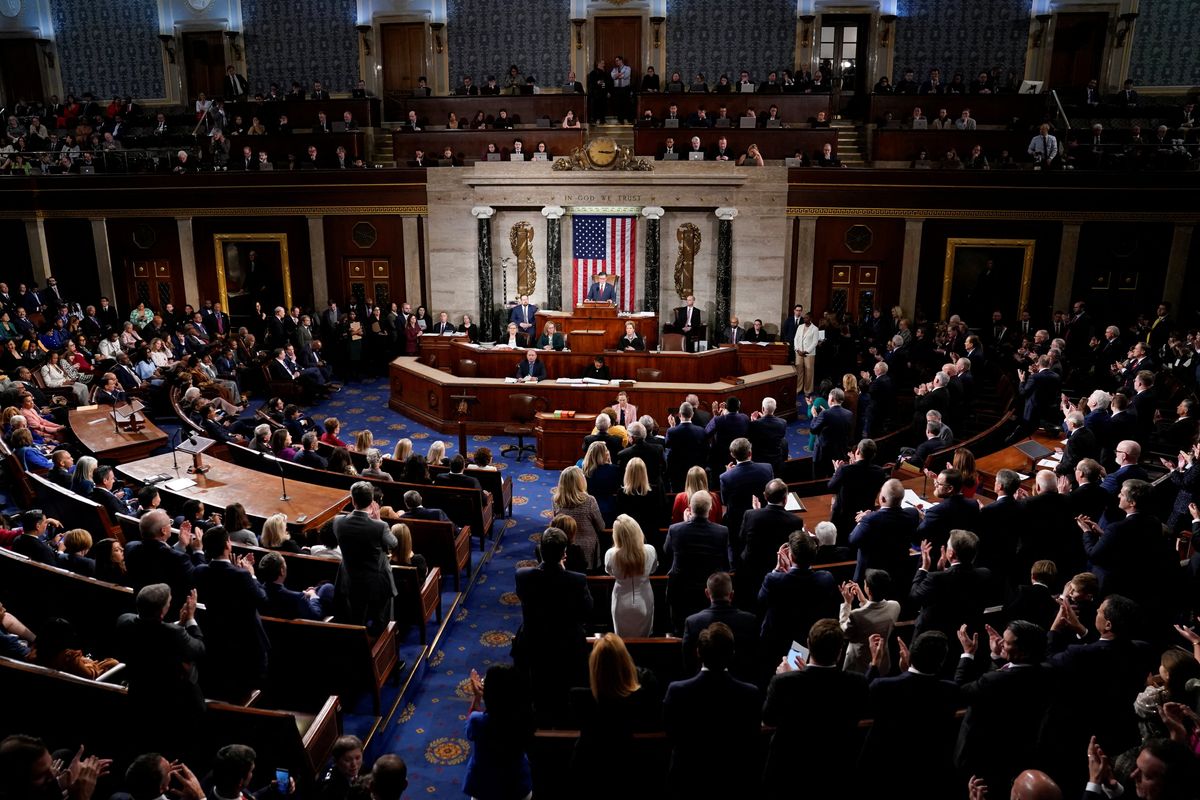

House and Senate Republicans are planning a broad package of tax changes to support President-elect Donald Trump's agenda, with one of their biggest priorities being extending the 2017 tax cut bill — although there is disagreement between the chambers on whether to pass those tax items on their own or bundle them with legislation on energy and border security.

"To start things off, corporations got a huge tax break from Trump and Republicans in 2017. Now Republicans want to give them another handout at a cost of $522 billion," wrote Wyden. "Here’s another $222 billion handout to huge, profitable corporations. Odds are, the corporations will turn a lot of these handouts into stock buybacks for the benefit of wealthy shareholders and executives."

ALSO READ: Fox News has blood on its hands as Trump twists the knife

As far as how to pay for them, Wyden noted, it's a laundry list of cuts to vital services.

"Republicans want to begin with a $192 billion tax increase on single parents," said Wyden. Additionally, "They want to repeal the IRA’s energy tax credits, which are what lowers carbon emissions and invests in clean energy. At a time when energy production in America is booming and clean energy is taking off, Republicans want to surrender the clean energy industry to China and raise your energy bills."

Other things on the chopping block, Wyden noted, include repealing green energy subsidies, the Child and Dependent Care Tax Credit, a $4 million program to reduce air pollution in schools, and the remainder of the Biden-era IRS funding increases to modernize tax collection and audit high-income tax evaders.

They are also exploring repealing the home mortage interest deduction, which would be a $1 trillion cut over 10 years, although this is one of the few proposed GOP cuts that would make the wealthy pay more.