U.S. Treasury Secretary Scott Bessent is one of the very few people who couldn't make money off a hedge fund, one expert dissed.

Investor Marshall Brandt, co-founder of the alternative investment firm Annapurna Funds, spoke to The Bulwark's Tim Miller about how bad a money person one must be to lose billions in hedge funding. That, however, is exactly what Bessent did when running the Key Square Group.

The two men mocked Bessent as a "so-called financial expert," but noted that while Bessent began with nearly $4.5 billion and built it up to $5 billion, the fund has seen nothing but steep losses ever since.

Brandt said that Bessent's work was in micro-investments, which means trading on bets for "anything under the sun."

"So, you make these really big bets on rates, fixed income, inflation, and he worked for some of the best," said Brandt, noting that Bessent worked for George Soros at one point, who is considered one of "the best of all time."

"He has the same profile I've seen a lot," Brandt explained. "You're a good PM [portfolio manager] and you spin out with your own fund."

"I feel for the guy a little bit," Brandt continued. "I mean, I don't know how exactly you put $4.5 billion to work on a Thursday. But he was down 50% of the time he was there. And the 'Golden Rule' for Soros and [Stanley] Druckenmiller as mentors is you never lose money. At least you can put it in 10-year Treasury [bonds]. So 50% of his years were down. And I don't see any way to view him as anything but a failed hedge fund manager."

When Bessent began the fund at around $4.5 billion in 2017, things went south after its first year. He ultimately ended up losing 90% of his capital, down to $577 million.

"If that had happened to our economy, for example, as Treasury Secretary, that would yield a lot of pain," Miller commented.

"It's interesting because he's kind of touted as the guy to calm Wall Street that the 'Dear Leader' is not going to ruin everything," said Brandt. "But there's not a lot of evidence he was so good on Wall Street."

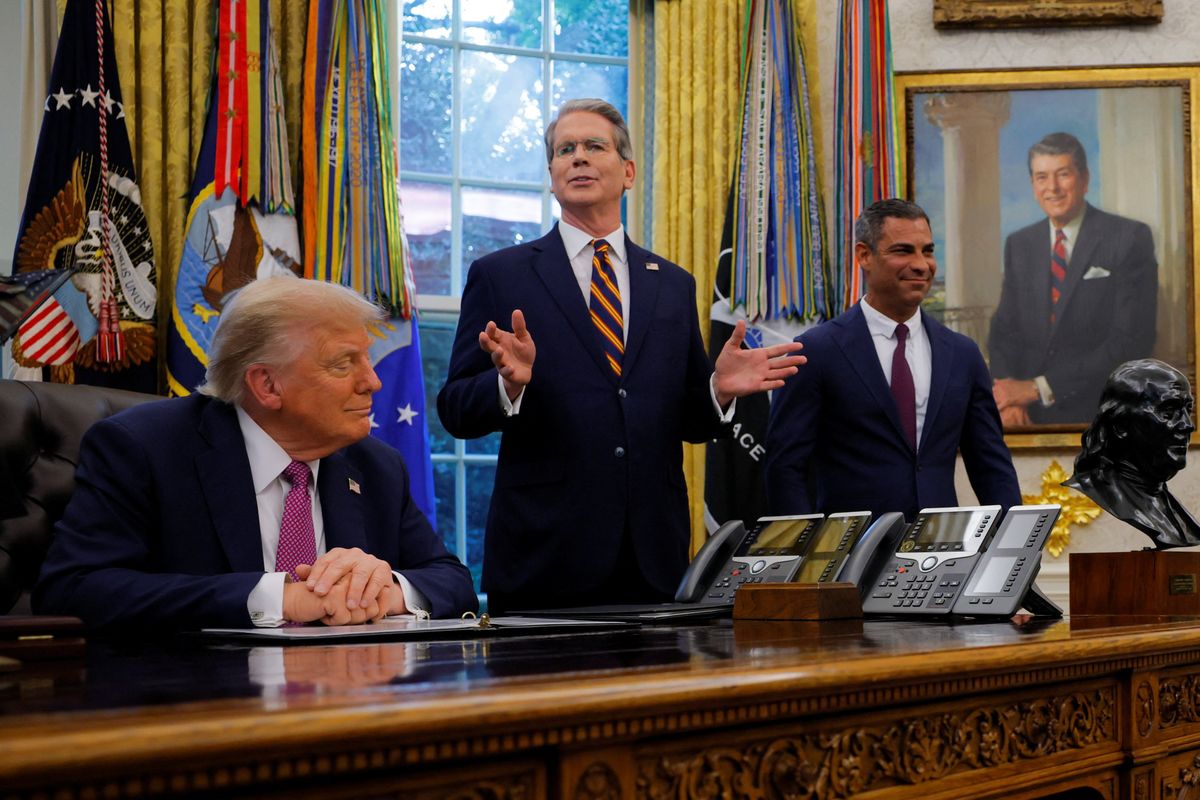

See the opening clip below via The Bulwark or at the link here.

How Trump’s Treasury Secretary Crashed His Own Hedge Fund (w/ Marshall Brandt) by The Bulwark

Read on Substack