The state of Texas is heading for a showdown with corporate leaders who are increasingly speaking out on social justice issues.

The finance industry's ties to Texas had until recently looked stronger than ever, with Wall Street giants Canyon Partners, Goldman Sachs, Charles Schwab Corp. and Vanguard Group all maintaining or building large operations in the state, but more than a dozen banking insiders say state officials are growing frustrated at corporate pushback to their increasingly conservative agenda, reported Bloomberg.

"This is much bigger than the municipal bond business," said former GOP senator Phil Gramm. "This is the beginning of telling Wall Street that if you're going to discriminate due to your fealty to special interest groups, you're going to have to pay for it."

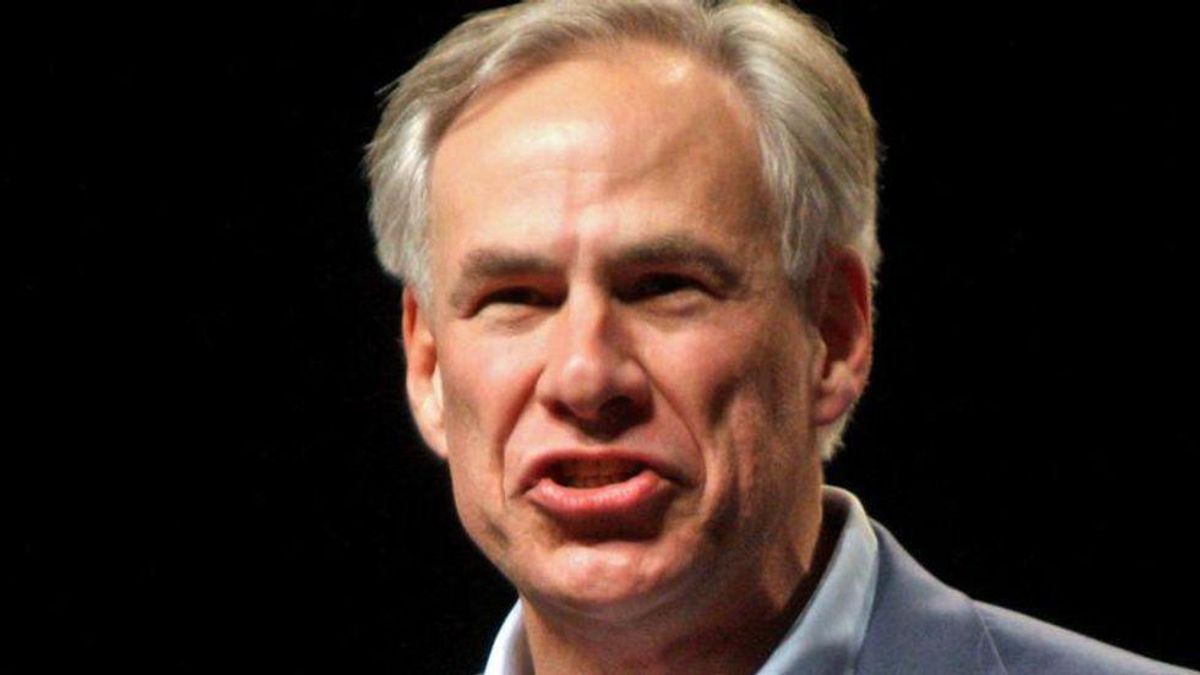

George Seay, the grandson of former governor Bill Clements and founder of investment firm Annandale Capital, said there's growing tension between corporate leaders who have "become woke" as Gov. Greg Abbott, who's running for a third term, presides over a rightward turn in the largely conservative state.

"[Boycotts are] not going to work down here," Seay said. "You can be friends with someone who doesn't agree with you."

Cullum Clark, a finance veteran who teaches economics at Southern Methodist University, said Texas was on a collision course with business leaders who disagree with the state's highly restrictive abortion and voting rights laws, anti-LGBTQ legislation and executive orders on the coronavirus pandemic.

"We will see more and more statements and measures like the Texas one, some left and some right," Clark said. "Wall Street is strong, these are not weak entities that have no resources. I think they're watching closely."