Let’s step back for a moment from the awful human tragedy in Ukraine as the Russian army targets civilians. There is an even bigger issue here. And until we come up with an answer it’s going to continue to plague the world.

It’s an issue that Americans, more than anyone else, should understand. Yet based on all the news and commentary I’ve been reading since the Russian buildup began almost a year ago, this overarching issue is not even on the table.

The bigger issue is that there is no way to stop a nuclear power from invading a non-nuclear power, as America did 18 years ago this month when it took down the dictatorship in Iraq.

And make no mistake, Vladimir Putin himself has long made clear that Ukraine is not the only country he intends to take over.

Three years ago I spent a week in Ukraine. Every person to whom I spoke, whether in a formal interview or casual conversation, said that Putin was going to invade their country.

Many of them expected an invasion while Donald Trump was in office. That made sense because Trump repeatedly declared his trust in and fealty to Putin, denounced American intelligence agencies saying he did not trust them and lambasted our NATO allies. Destabilizing and, if possible, shuttering NATO is a long-term stated goal of the modern Russian tsar, as foreign affairs columnist Trudy Rubin explained recently.

Putin, whose words I have carefully read for two decades, doesn’t plan to stop with Ukraine. He has called the collapse of the old Soviet Union the worst geopolitical disaster of the 20th century and has said he is determined to put it back together. His words:

“Above all, we should acknowledge that the collapse of the Soviet Union was a major geopolitical disaster of the century. As for the Russian nation, it became a genuine drama. Tens of millions of our co-citizens and co-patriots found themselves outside Russian territory.

“Moreover, the epidemic of disintegration infected Russia itself.”

Fear in The Baltics

For more than a decade the political leaders of the Baltic states – Estonia, Latvia and Lithuania – have been telling every visiting journalist willing to listen that sooner or later they expect Russian tanks to overrun their countries.

I have family, via a son’s marriage, in Slovakia. They fear that Russian tanks will come, though they know not when; anxieties deepened mightily by the invasion of Ukraine.

We don’t need to worry about Moscow and Washington wiping each other out with atomic bombs.

What kept the rivalry between Washington and Moscow a Cold War, what kept either from launching nuclear ballistic missiles, was the concept of MAD – Mutually Assured Destruction.

That idea was articulated in a 1962 speech by Robert McNamara, the former Ford Motor chief executive whose hubris was unbounded. He believed that his team could use math, logic and aerial bombing to defeat the Vietnamese who wanted to be free of Chinese, French, Americans or any other oppressor. Never mind that post-World War II studies showed bombing can disrupt war material manufacturing and sow fear, but that’s pretty much all. Its overall effectiveness is disputable in a largely agrarian society. The old Soviet called Ukraine “The Ukraine” and Russia’s breadbasket.

While we may yet see a limited nuclear war using small battlefield nuclear bombs, all-out nuclear war would leave the world with nothing but ashes and an aftermath of deadly radiation.

MAD doesn’t mean that two nuclear powers will never confront one another on the battlefield. We have seen, for example, repeated skirmishes between troops in Kashmir, parts of which are disputed territory claimed by two nuclear powers, India and Pakistan. But neither New Delhi nor Islamabad is likely to risk losing their capital city to nukes over parts of a region about the size of Minnesota or Utah.

That said, MAD doesn’t apply when a nuclear power attacks a non-nuclear power.

That few people grasp this is evident in all the silly talk by politicians and pundits about creating a no-fly zone over Ukraine to take away invading Russia’s air power advantage. Indeed, such talk perfectly illustrates the impotent options for stopping an invading nuclear power from seizing any non-nuclear country.

No-Fly Zone Nonsense

The no-fly zone notion also shows a widespread lack of critical thinking skills in America.

Creating a no-fly zone starts with taking out radar, rocket launchers and other military equipment that would pose a threat to patrolling military planes needed to enforce the no-fly zone.

Even without putting a single jet fighter or reconnaissance plane in the air to make sure Russia could not use Ukrainian airspace we would be at war with Russia.

This is no small matter. Russia holds almost half of the world’s nuclear weapons, an estimated 6,257 out of 13,080.

In 2014, during his invasion of Ukrainian Crimea, Putin denied that he deployed “little green men” whose military uniforms lacked insignia. After his forces took control, giving Russia a warm-water port, Putin laughed that of course those were his soldiers.

When then-President Barack Obama and other Western leaders spoke of Putin’s invasion of Crimea being wrong, the modern tsar upped the ante. Putin threatened the use of nuclear weapons. “It’s best not to mess with us,” he declared.

Only so long as Russia does not confront conventional forces from NATO, with its nuclear weaponry in reserve, there is little danger that Putin would turn to The Bomb.

It is important, however, to know that almost a third of Putin’s nukes are battlefield-sized weapons, smaller bombs to take out battalions comprised of hundreds of soldiers, not cities. Only a fool would rule out Putin launching small tactical nuclear weapons if for no other reason than to terrorize people and make clear the depth of his determination to rule, as Stalin, did over a vast empire that includes some countries that today are free from Russian domination.

Satellites Join NATO

Some of these former Russian satellites are not only free, but they also joined NATO. Among them: Bulgaria, the Czech Republic, Hungary, Poland and Slovakia.

Putin says NATO is the aggressor against Russia. For sure it’s unnerving for NATO to exist if you are in Putin’s shoes. Imagine if the oceans surrounding us, Canada and Mexico were all Russian satellites in a military alliance to contain the United States. But there’s zero evidence the West plans to invade Russia or any other country.

Putin points to the NATO intervention against Serbia in the war in the Bosnian war (or as our managing editor used to say, the war in Bosnia-Schizophrenia). But NATO didn’t start that conflict with its ethnic cleansing, it just stepped in to stop it.

So how to address nuclear powers invading non-nuclear ones?

One obvious solution – an atrocious one – would be to make every country a nuclear power.

That’s crazy. Corrupt military officers or a revolt could put the bomb in the hands of terrorists, religious zealots, criminals or just plain crazy people. Hollywood has long played with this terrible idea in films from The Peacemaker in 1997 to several of the James Bond fantasies.

It Starts With Lies

Invasions by nuclear powers start with lies, palpable lies that deceive because they come with a patina of truth, making them easy to fob off on those without critical thinking skills and the politicians who live in fear of losing their grip on power.

Both America’s Iraq invasion and Russia’s Ukrainian invasion of choice were based on calculated lies.

The George W. Bush administration ginned up tales of Iraqi weapons of mass destruction, persuading many gullible politicians and journalists.

When George W. Bush warned that Iraq had nuclear weapons the statements were palpably false. Besides, if Saddam Hussein had them we would have known.

A Radioactive Cat

As far back as the 1984 Olympics in Los Angeles, I wrote about how incredibly sensitive nuclear detection equipment would spot any effort to slip a nuclear bomb into Southern California. The entire Southern California region was mapped for radiation levels before and during the games. (My story on which buildings nuclear arms experts said would be the prime targets for a Russian nuclear attack in Southern California, to run as a map overlay on a two-page map of the games venues, was killed by spineless Los Angeles Times editors.)

In 2008, the Seattle Times reported that a car returning from Canada at 70 mph was stopped after a border agent, parked in the freeway median, detected nuclear isotopes. What the agent found was a cat treated for cancer three days earlier with radiation.

So, without a doubt, if Iraq had possessed nukes, we would have known. Ditto the baseless insistence by the younger Bush administration that Iraq had created and amassed biological weapons which a demonstrably gullible reporter turned into worldwide news.

The official British inquiry into the Iraq invasion, known as the Chilcot Report, is devastating in its detailing of the lies, miscalculations and self-delusions that preceded the invasion.

I recommend reading Pages 40 – 62 of the Executive Summary (the full report runs 530 pages). It also shows how invading Iraq decreased stability and put Britons and others at greater risk of terrorist attacks by pointlessly fostering hatred of the invading allied nations.

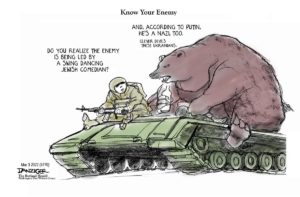

In this same vein of official lying to justify the unjustifiable, Putin and his cronies tell the Russian people that the invasion is to defend Mother Russia from attack and to remove modern Nazis from the Kyiv government.

Putin’s Nazi Nonsense

What Russian state media – Putin has shut independent news – don’t tell people is that the elected president of Ukraine, Volodymyr Zelenskyy is a Jew.

Jeff Danziger Cartoon

To be sure, there certainly are very far right-wing elements in Ukraine, just as there are neo-Nazis in the United States and many other countries. But to claim that Nazis or their modern ideological descendants control Ukraine is absurd. Pardon me while I take a moment to laugh out loud.

It’s also astonishing how few news reports and comments by elected officials note that eight years ago the Ukrainian people rose up and deposed a Putin puppet who had been stealing hundreds of millions of dollars from the public treasury. Its known as the Orange Revolution.

The deposed Russian puppet built a lavish palace where before fleeing his staff dumped incriminating documents. Recovered ledgers showed payments totaling tens of millions of dollars to Paul Manafort, who later became Donald Trump’s 2016 campaign manager. The 2016 Republican National Convention gutted its former stance and adopted Russian perspectives on Ukraine at Manafort’s and Trump’s urging.

GOP Drops Kremlin Skepticism

Before Trump, Republicans were ferocious critics of Kremlin behavior. In the 1950s they conducted official hunts for Reds hiding under beds and working at the State Department and Pentagon.

Now Trump and many Republicans side with Moscow. So does Fox News’s Tucker “I’m rooting for Russia” Carlson, the No.1 cable host in America. Carlson is trying to walk back his comments, but what I hear each night is just nuanced pro-Kremlin chatter.

Also missing in our national discussion is the Ukrainian diaspora. Under the old Soviet Union, millions of Russians were forced to move into Ukraine, diluting the local ethnic population. Before the invasion more than one in six Ukraine residents was Russian. Also, a few decades ago Ukraine had a population of more than 50 million, but today only about 40 million.

As Ukrainians flee for their lives that ratio will rise. Putin will no doubt tout future census numbers to support his nonsense claim that Ukraine is part of Russia, a subordinate part.

Kyiv Ancient Unlike Moscow

Kyiv was a thriving city a millennia ago. Back then Moscow was a wide place in the forest with a few huts. There’s a strong case for saying Kyiv is the mother of Russia, but not the other way around as Putin insists.

So how is the world to deal with invasions of non-nuclear countries by nuclear powers? I don’t have an answer, but I do have a suggestion: We need to study and devise a new global doctrine to address this menace.

And I suggest using my imaginary analytical friend, the Cosmic Journalist, to analyze the issue.

The Cosmic Journalist, coming here from another planet, can be clear-eyed. This tool for inquiry can appreciate that Putin feels contained by America, with its oceans on each side. U.S. allies simultaneously recognize that Putin’s disappointment at the collapse of the Soviet Union is no grounds for invading other countries.

Featured Image: Pixabay

NOW WATCH: Fox News reporter pushes back when host Greg Gutfeld accuses media of ginning up 'emotional' Ukraine reaction

Fox News reporter pushes back when Gutfeld accuses media of ginning up 'emotional' Ukraine reactionwww.youtube.com